What You Should Know About the UK’s Cap & Floor for LDES

UK Government Cap & Floor scheme is aimed at supporting the rollout of Long Duration Energy Storage projects across the UK.

On 11 March 2025, Ofgem released the Technical Decision Document confirming key final details of the UK LDES Cap & Floor Scheme, originally announced by the UK government in October 2024. This Long Duration Electricity Storage (“LDES”) investment support scheme supports the rollout of LDES projects across the UK by providing guaranteed revenues to developers. The scheme was widely welcomed by industry participants including Invinity; the first application window opened on 22 April.

What is the UK’s Cap and Floor LDES Scheme?

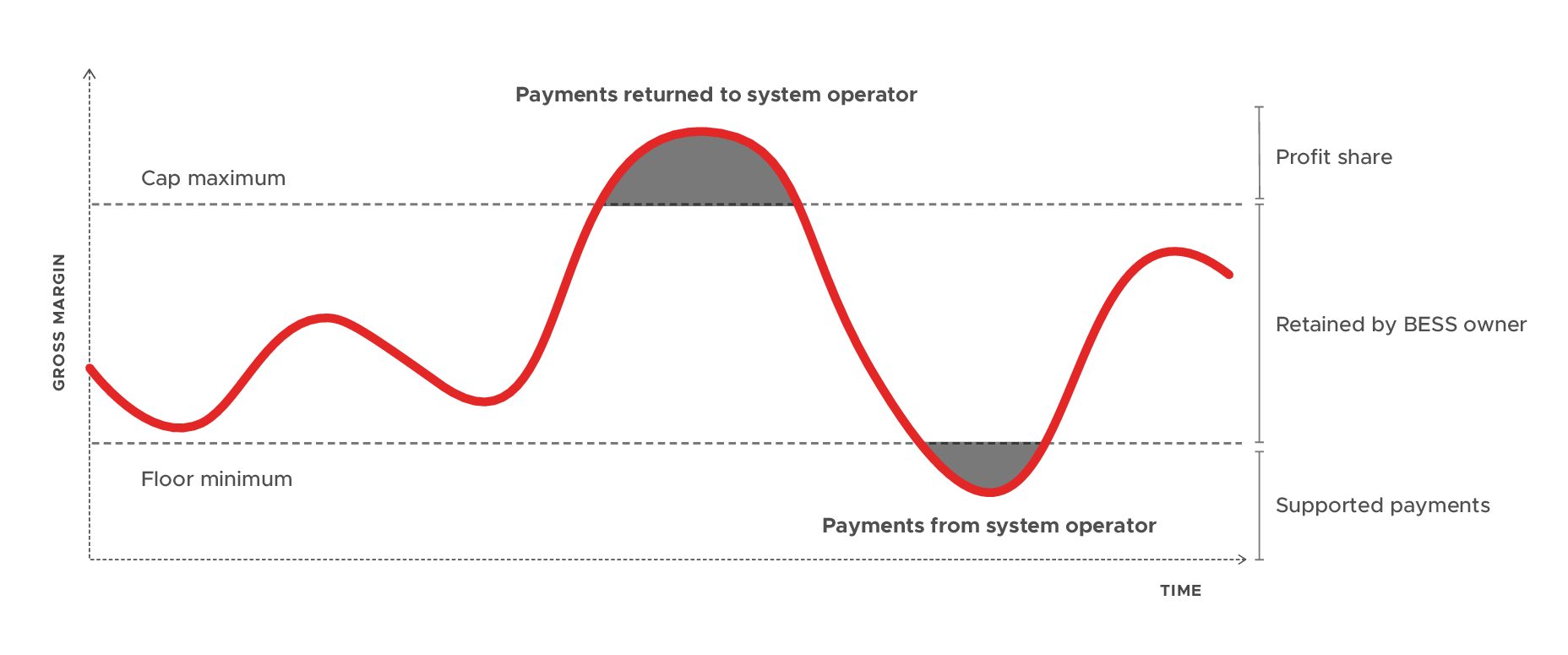

The cap and floor LDES scheme provides revenue support to developers should their gross annual margin (the difference between the revenues from selling electricity back to the grid, and the cost of charging) fall below a set threshold known as the “floor”. A similar approach was successfully utilised in the past to support the build out of the UK’s interconnector projects.

The revenue “floor” essentially acts as an insurance mechanism. Levels are set low to minimise the likelihood of its use, while still providing comfort to investors that operators can meet debt payments in the unlikely scenario that revenues are much lower than forecast. In return for underwriting this risk, the revenue “cap” ensures that LDES asset owners must share some or all profits above a certain level. Project lengths under the scheme are expected to be a minimum of 25 years.

Which technologies qualify under the Scheme?

As anticipated, eligible technologies have been split into two application routes, being Stream 1, which focusues on most-mature technologies (specifically Pumped Hydro Storage (“PHS”)), and Stream 2, which is dedicated to proven, innovative technologies such as flow batteries.

Technologies Qualifying Under Stream 2

- Vanadium Flow Batteries (VFB)

- Flow Batteries

- Liquid-Air Electricity Storage (LAES)

- Compressed-Air Electricity Storage (CAES)

As some of these LDES technologies can provide very long storage durations, this broad range further highlights that the UK is keen to support the deployment of a wide range of energy storage of varying durations to enable the transition to net zero, with the most proven of these being the Vanadium Flow Battery which is the most widely deployed non-lithium battery technology on the UK grid today.

What are the Cap & Floor project criteria?

Full criteria for LDES projects in the UK can be viewed in the Technical Decision Document (TDD). Importantly, the TDD contains a number of confirmations which underline the suitability of Invinity’s technology and an appropriate development pathway for Stream 2 of the scheme, including:

- A two-month application window which opened in April 2025;

- An indicative total capacity of between 2.7 and 7.7 GW;

- A minimum 8-hour storage duration (increased from 6 hours under the previous guidance);

- A minimum project size requirement of 400 MWh (increased from 300 MWh under the previous guidance);

- A 25 year project life target with no degradation of asset performance; and

- A programme floor that is intended to support returns on all invested capital, including both debt and equity.

Minimum power output

Duration

Underlying the fit with Invinity’s vanadium flow batteries, the scheme’s stated objective is “to provide a route to market for mature and near-mature LDES technologies which are not commercially viable under existing arrangements.”

Does the Scheme have requirements for efficiency?

During the consultation, some respondents proposed minimum round-trip efficiencies (RTE), noting that certain technologies (such as some CAES and LAES) achieve a relatively low RTE rate of below 65%. In contrast, Invinity’s vanadium flow batteries achieve significantly better efficiency than many other LDES technologies. The world-renowned testing and certification agency, DNV, completed a bankability study in 2023 on Invinity’s VS3 product, which demonstrated a round-trip efficiency of 75%, and Invinity’s Endurium product, launched in December 2024, provides even greater efficiency and storage capacity.

The Government’s response is that they are “minded not to propose a minimum efficiency rating as part of the eligibility criteria for projects at this time.” However it has stated that it will work with Ofgem to consider how best to consider efficiency.

What are the revenue opportunities to achieve ROI?

The Government outlined in its response to question 28 that “we want assets to maximise all available revenue streams and envisage the CM playing a key role here”.

Invinity’s Vanadium Flow Batteries already offer operators the ability to bid into a broad range of ancillary services markets and grid services. Our energy storage systems are capable of sub-second response times and qualify for most fast response services in major markets.

Where they exist, Invinity systems are capable of providing energy storage for grid services markets including:

- Frequency & voltage control services

- Balancing markets

- Demand response

- Local flexibility

- Operating reserve services

Are there local manufacturing & supply chain benefits?

Many respondents to the Cap and Floor consultation outlined that local economic and wider societal benefits should be considered for UK-based LDES projects. These suggested benefits include energy sovereignty (in the face of geopolitical issues), longevity of the asset and system efficiency, which includes reduced network capacity and generation capacity requirements.

The Government confirmed in its response that to this question that “these benefits will be considered as part of the application assessment” thus allowing these UK LDES projects to be assessed on considerations wider than costs. The exact criteria thresholds will be further defined and published alongside the full scheme details.

Invinity’s VFB technology meets all of the expected key criteria and can provide a range of merchant and contracted battery revenue services for UK-based Cap & Floor scheme projects. The fact that Invinity’s batteries are Made in Britain is also expected to be advantageous for developers applying for Cap & Floor support in addition to the planning and permitting benefits gained from the inherently non-flammable nature of Invinity’s products.

Talk to the Invinity team today about your UK LDES project

If you’re a utility, developer, EPC, or financier looking to deploy a cap and floor supported UK LDES project, please contact our commercial team to discuss the details of your project.