What does the recent UK AR4 funding round mean for Energy Storage

Invinity’s Markets and Analytics Manager, Jeffrey Douglass, breaks down the key aspects of the AR4 auction round and outlines the opportunities presented.

Monday 18 July 2022

In early July, almost 11 GW of renewable generation capacity were accepted for Contract for Difference (CfD) contracts in the latest AR4 auction, reflecting the UK government’s commitment to supporting zero-emissions generation to improve energy security and deliver a net-zero electricity grid by 2035. The revenue security offered by these contracts will advance the pipeline of renewable generation projects, with contracts to start generating in the next 4 years, of which the largest pool is 7GW of offshore wind whose contracts start in 2026. All but 30 MW (which is allocated to Energy from Waste) have been granted to solar, wind and tidal generation, whose output naturally features hourly, daily, weekly and seasonal variability.

Above: Jeffrey Douglass and Simonas Vainauskas during a recent presentation of Invinity’s Energy Storage technology to members of RPS

This additional low-cost, inflexible electricity supply will increase the price volatility in energy markets, opening up intra-day price spreads that can be captured by energy storage. With a close-to-zero marginal cost of generation, these assets shift the marginal generation price stack when the sun shines or the wind blows towards lower-cost marginal plant, reducing prices in wholesale electricity markets. As a result of both falling capture prices and lower utilisation, fossil-fuelled generation will have to resort to recovering more of their costs through the capacity market which is designed to maintain system security. These inflexible assets also push additional value into the Balancing Mechanism which is used by the Energy System Operator to address system stability issues (e.g. maintaining minimum inertial generation, managing network congestion) and to correct energy imbalance (e.g. caused by generation forecast errors). With a capture price guaranteed by the CfD, these assets are pushing the bid price (the price a generator will pay not to have to operate) below zero when excess wind needs to be turned down. All of this adds up to increasing price spreads and increasing tradeable volumes for energy storage, boosting asset value.

A change in regulation for this latest auction round (and now retrospectively applied to previous CfD assets) is that renewable developers are freer to benefit from coupling energy storage, such as a high-throughput flow battery, with on-site generation. Provided they can demonstrate that the energy discharged from the storage asset is metered separately from the generator with the CfD, generators are able to take advantage of high, volatile peak-time prices by opting to charge storage instead of accepting the CfD price. This upside opportunity adds to the value of co-locating generation and storage assets.

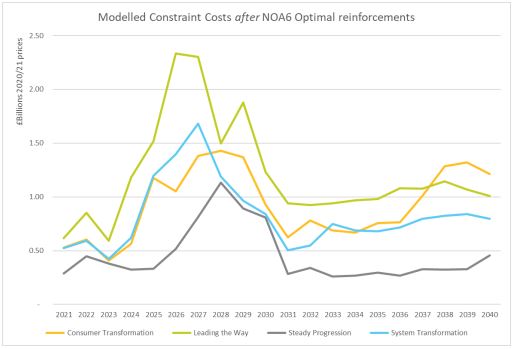

At a system level, these auctions are pushing towards UK government targets of increasing offshore wind capacity to 50 GW by 2030, in line with the capacity buildout included in National Grid Future Energy Scenario. These generators will be competing for limited network capacity, requiring costly additional network investment to avoid excessive curtailment, and increasing volumes and price volatility in the Balancing Mechanism to balance the system until this can be delivered. Analysis carried out as part of the Network Options Assessment program have highlighted the implications of renewable buildout for constraint costs which, in the Leading the Way scenario, are predicted rise to £2.3bn per year in 2026. These costs will be paid to dispatchable generators, including energy storage which increases the utilisation of zero-carbon generation instead of replacing it with high-carbon generation.

Above: Modelled Constraint Costs after NOA6 optimal reinforcements. Source: National Grid ESO

These technical and market fundamentals present a strong long-term policy (and economic) outlook for the value of energy storage in an increasingly decarbonised electricity system, despite short-term pile-in to natural gas.