Guest blog: Recycling Matters / Shining a light on a growing battery waste problem

Simonas Vainauskas, Energy Analyst, explores some of the complex issues surrounding battery waste, recycling, and the widely underappreciated impact battery end-of-life considerations may have on the global energy transition.

Battery energy storage was an important talking point at COP 26 as one of many solutions for meeting the world’s decarbonisation targets. The underlying idea appeared familiar: as the phasing out of fossil fuel generation continues, grid-scale energy storage becomes crucial to cope with the resulting generation intermittency and enable grid flexibility. However, not all batteries are created equal, especially when it comes to dealing with them when they reach end of life. An ever-growing waste problem threatens to offset many of the benefits that batteries deliver, with potentially significant consequences for the global energy transition. The answer? Recycling – but is it really that simple? Yes and no…

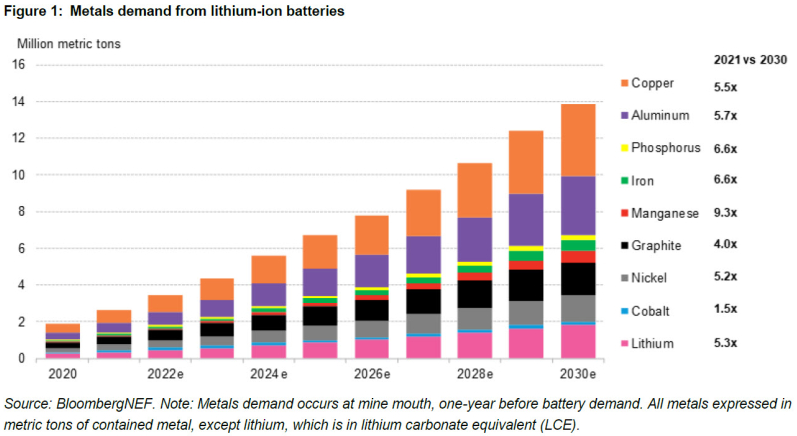

Above: BloombergNEF forecasts to 2030 show sizeable resource demand growth, making the problem of dealing with future lithium battery waste ever more pressing

Pushing for sustainable progress

Currently, the stationary energy storage market is dominated by lithium-ion battery technology, particularly in short duration applications for up to 4 hours. Thanks to EV R&D efforts, Li-ion modules have shown the steepest battery cost reductions per kWh, falling 89% in real terms from 2010 to 2020. On a surface level, this signals a positive change: cheap batteries mean more energy storage, presenting investors with lucrative business cases while helping countries meet their decarbonisation targets!

In reality, the energy sector, like others, has fallen victim to choosing cheaper products over more sustainable options. Existing Li-ion stationary storage projects that were built in the 2010s are already likely to be reaching the halfway point of their expected asset lifetimes. As the industry is very nascent, what will happen at End Of Life (EOL) for these batteries is therefore an unknown. To add further complexity to the issue, regulations for recycling stationary storage batteries are very ambiguous, most of them applying only to small-scale consumer lithium batteries and there is little in the way of market incentives to encourage industrial battery recycling.

To top it all off, lithium batteries degrade with frequent cycling and age. To tackle this, the manufacturers rely on augmentation, a process of replacing degraded cells to maintain capacity. Therefore, augmentation results in more battery waste from each project than its nameplate capacity advertises. With one eye on a “Just Transition” and certainly from a sustainability perspective, we need to work out if we can continue to use lithium-ion for utility-grade energy storage.

Above: A worker in a used battery recycling facility in Turkey

Is lithium-ion battery recycling a problem?

To understand the recycling challenges for lithium batteries, we need to first examine the products available in today’s market. Currently, the two most prevalent types of cells used in stationary energy storage applications are lithium NMC (Nickel Manganese Cobalt Oxide, LiNiMnCoO2) and LFP (Lithium Iron Phosphate, LiFePO4). Despite these batteries being branded as lithium-ion, the actual lithium content within the NMC and LFP cells ranges between 2 – 7% depending on manufacturer and cell chemistry. What incentivises the recycling of these batteries is their precious metal content such as manganese and cobalt. However, with the market trends showing an increasing uptake of LFP cell technology that contains no nickel or cobalt, and the likes of Tesla adopting LFP for their grid storage applications, the economic viability of recycling these (increasingly LFP-dominated) batteries is becoming very difficult and presents a need for policy intervention.

The policy front, however, appears to be moving slowly. Having researched lithium battery recycling regulations in some of the world’s leading economies (U.S., EU, Canada, China, Japan, Australia), the ambiguity in policy appears striking. The conflict between different levels of regulation (e.g. State vs Federal in the U.S.) as well as across different institutions makes it difficult to summarise and compare definitively. Therefore, a simplified overview of the countries’ policy efforts in stationary storage lithium battery waste management looks something like this:

Australia currently has no EOL stationary storage battery waste regulations in place, ranking them at the bottom of the list. Similarly, Canadian mandates exist for Li-ion waste collection programmes in the provinces of BC, Manitoba and Quebec, however these only cover waste from portable electronics and not industrial scale energy storage. Next in line is China, with the government mandating responsibility for EV manufacturers to recover their EOL batteries, to which big players like CATL are responding with plans to establish large-scale recycling facilities.

Above: used Li-ion phone batteries

Finally, the EU and the US appear to have the most relevant (though still ambiguous) policies. In late 2020, the European Commission re-evaluated its 2006 Battery Directive, inferring that it failed to include the collection of waste industrial batteries in the document and bearing no reporting obligation for manufacturers. The issue was classified as ‘high concern’ due to rapid stationary storage uptake trajectories and was flagged as a “key area for improvement of the directive”.

Meanwhile, under the US RCRA regulations, lithium batteries are not explicitly listed as a hazardous waste, but the Department of Transportation regulations do classify them as such. At present, no facility in the US fully recycles Li-ion batteries although a commercial-scale recycling plant in Georgia by Battery Resources is scheduled to begin operating in August 2022. In addition, various non-state programmes for portable lithium waste collection exist.

The complexities of battery recycling

As mentioned at the beginning of this article – we do not know what decommissioning transmission scale lithium systems is likely to look like. We can, however, extrapolate the lessons observed in managing portable battery waste and decommissioned stationary storage below accepted capacity limits.

The fire safety hazards of Li-ion cells are present not only in ‘live’ batteries but also the entire way down the waste management chain – transport, handling and discharging. This risk has been observed in recycling trucks where waste is compacted for transportation, causing Li-ion cells to explode and ignite the waste. Further down the chain, Li-ion battery waste can catch fire or explode in waste incineration facilities that use high temperature treatment or crushing methods. Once disposed of, the batteries have been also known to cause fires in the landfill. Finally, the landfilled Li-ion cells have a chance of releasing toxic elements into the soil and surrounding water bodies, known as leaching.

The health and safety concerns result in additional environmental and societal costs not borne by the battery manufacturers. This raises some questions: first, whether the insurance costs are being appropriately costed; and second, what cost will the owners of lithium batteries nearing EOL face as recycling regulations become stricter. Additionally, battery waste ownership is uncertain, creating further issues. For example, in the US at the time of project commissioning the liability is typically assigned to EPCs. However, once the project is decommissioned, the policy deems its owner a generator of hazardous waste and therefore liable for proper disposal of the waste. This is an added cost to potential Li-ion battery owners that they may not want or be able to manage.

What are the alternatives?

In the context of providing the services required by today’s grids – e.g. frequency response, reserve services, network congestion alleviation – VFBs can be considered an adjacent, complementary technology to lithium batteries. In other words, flow batteries can provide many of the same services without suffering the cycling-attributed degradation and calendar ageing consequences. Encouragingly the vanadium electrolyte does not degrade and at the end of the battery’s useful life is 97% recoverable and can be used for a new system or sold in the market, providing positive returns for the asset owner.

Above: Invinity VS3 batteries at the Energy Superhub Oxford Project

Looking beyond lithium-ion

Clearly the world has a problem with battery waste and as we increasingly electrify our systems, processes and daily lives, this problem is only going to grow. Whilst it’s heartening to see real, encouraging first steps towards addressing the issue of lithium-ion battery recycling, it’s still unclear how this will develop at scale, especially in light of volatile commodity markets.

With COP26 now behind us, hopefully the world is finally waking up to the fact that we need to take action now to avoid a climate emergency. However, this needs to be a ‘Just Transition’, delivered via sustainable, durable and economic solutions. The best part? These solutions exist now, so there’s no need to wait.