Invinity’s Energy Solutions Manager, Alex Moor reviews Canada’s historic commitment to clean energy as part of the 2023 Budget and gives view on what this really means for energy storage projects in Canada.

Monday 3 April 2023

Project developers in North America are no strangers to Investment Tax Credits (ITC) and the 2023 Canadian federal budget continues that theme with the announcement of new incentives and provides further detail on previously announced benefits in the 2022 fall budget. Before diving into the ITCs, the budget also includes two other notable announcements that will play an important role in continuing to promote investment in new and established clean technology in Canada:

First, a further $3.0 billion in funding over the next 13-years to Natural Resources Canada which will help develop Canada’s offshore wind potential, recapitalize the incredibly popular Smart Renewables and Electrification Pathways Program (SREP) (that was initially funded with $964 million in June 2021 and received an additional $600 million in the 2022 budget) and revive the Smart Grid Program that distributed $100 million to 22 smart grid projects in 2020 – 2021. These programs have been instrumental in closing any funding gaps for both established renewables and emerging technologies including energy storage across all provinces that might not otherwise have seen renewable projects deployed. Crucially, the recapitalisation of these programs and the introduction of the ITCs apply at the “project” level presenting attractive opportunities over the coming years to create and develop an investable project that a few months ago may not have been commercially viable. Our team has been working across a number of provinces and several business cases and can work with you to quickly establish how energy storage and Invinity’s flow batteries might be able to fit in your projects and take advantage of these new funding opportunities.

Secondly, the Canada Growth Fund has received $15 billion to attract private investment by using financial instruments such as Contracts for Difference (CfDs) to provide future price certainty on the price of carbon for example ensuring that projects that are driving down carbon emissions will see the full benefits of the planned 2030 $170 per tCO2 carbon price benchmark. While the details on the CfDs are yet to be released, introducing a scheme to de-risk projects during their operational phases and providing an element of price certainty for future revenue streams is going to be an important mechanism to drive investment in renewable energy and decarbonisation measures.

Now onto the ITCs. The first is the launch of a new ITC for Clean Electricity which will provide a 15% refundable tax credit for investment in zero carbon generation systems (i.e. solar, wind, hydro, nuclear), energy storage and transmission network equipment to further support the growth and penetration of zero carbon electricity between provinces. This ITC is primarily aimed to support investment by non-taxable entities such as municipally owned entities and Crown corporations that might not otherwise have been eligible for the Clean Technology Investment tax credit announced in the 2022 fall budget.

This should spur further large scale investments in clean electricity and might help enhance the business case for transmission infrastructure owners to invest in energy storage as a non-wires alternatives to support existing and ageing transmission infrastructure. Along with the previously announced tax credits, there are specific minimum labour and wage requirements to receive the full tax credit; in addition, for the Clean Electricity tax credit there will be a requirement that the proposed investments will be used to lower electricity bills and help meet the federal commitment to achieve a net zero electricity sector by 2035. The final details on how this will work aren’t clear at this time but it stresses the importance of using the right type of energy storage technology.

On the supply side, a tax credit has been launched to support Clean Technology Manufacturing providing a tax credit of 30% of the cost of new investment in machinery and equipment that is used to manufacture clean technologies including energy storage and the extraction, processing or recycling of critical minerals for clean technology supply chains. While the critical minerals that are being focused on as part of this budget are only lithium, cobalt, nickel, graphite, copper and rare earth elements, vanadium is a key part of Canada’s Critical Minerals Strategy and as we begin to see a growing industry in Canada around vanadium recovery (Suncor’s first plant in Alberta), hopefully we will see this tax credit extend further down the vanadium battery supply chain.

Although not new, the 2023 budget has released details on the ITC for Clean Hydrogen with support ranging from a 40% ITC for hydrogen produced with a carbon intensity of <0.75kgCO2/kgH2 reducing to 25% for production at a carbon rate of <$2.0 kgCO2/ kgH2 and 15% for anything below $4.0 kgCO2/kgH2. Renewable electricity generation is going to be at the heart of ensuring hydrogen can be produced at the lowest carbon intensity tier of <$0.75/kgCO2/kgH2, and ensuring high load factors on equipment such as electrolysers is key to reducing hydrogen generation costs.

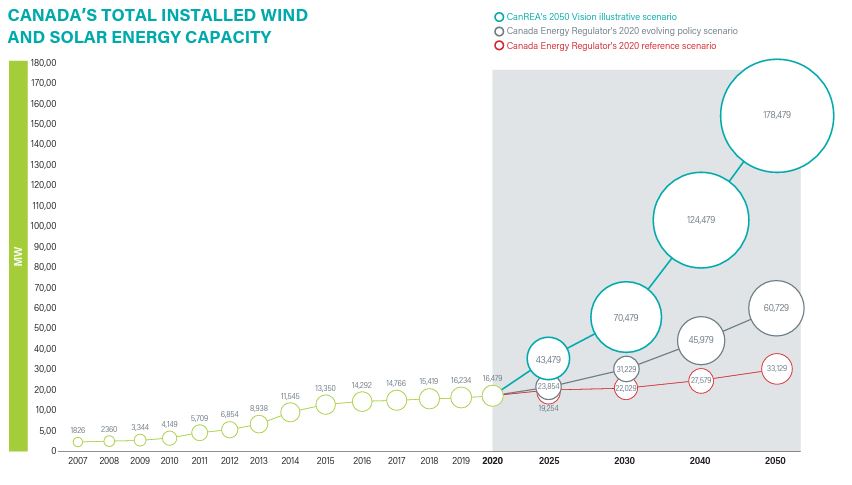

Above: Expected Wind and Solar deployment forecast from CANREA 2050 report

We should see a growing demand for zero carbon generation such as solar, wind and energy storage which will help install more generation capacity, reduce renewable curtailment and increase hydrogen generation load factors. Projects that are combining multiple clean technologies with hydrogen generation will be able to take stack tax credits reducing the cost of clean generation equipment by up to 30% under the Clean Technology ITC and the hydrogen generation equipment under this ITC. We’re beginning to see the first few concepts for clean hydrogen generation hubs in Canada (for example, EverWind Fuels) and this will likely further push development of combined utility scale solar, wind, storage and hydrogen generation facilities.

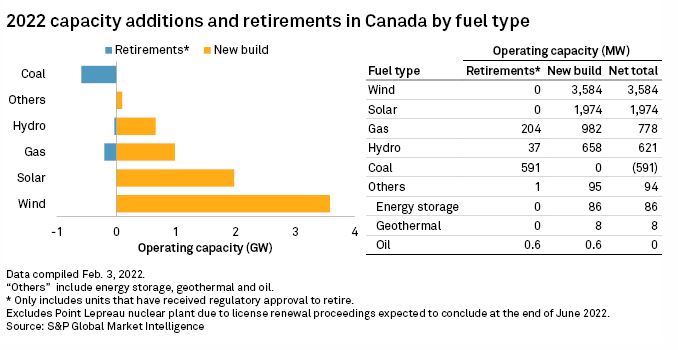

Above: Article outlining how Canada is to add more than 5.5GW Wind/Solar from February 2022 – source: https://www.spglobal.com/marketintelligence/en/news-insights/podcasts/energy-evolution-battery-makers-and-miners-turn-to-blockchain-to-solve-transparency-concerns-incentivize-investment

As Invinity continues to build out significant manufacturing capacity at our Vancouver hub, we’re excited to see this strong commitment taken by the federal government towards what Deputy Prime Minister and Minister of Finance Chrystia Freeland aptly calls “the race to build the clean economies of the 21st century.” These incentives should help unlock and accelerate projects like the Chappice Lake Solar and Storage project – a model for renewable energy on the Alberta grid that is currently nearing completion. If you’d like to learn more or discuss your own project with us, we encourage you to contact our team today.