Guest Blog: Is wholesale price volatility the ‘new normal’ for UK energy markets?

In the first of an ongoing series of blog posts from the Invinity team, Thomas Johnston, Business Development Analyst, gives his view on what effect the global COVID-19 pandemic is having on wholesale market prices in the UK, what this might mean for the future and how you can mitigate price risk with energy storage.

Sat at my desk, working remotely like most of you reading this, I started to consider the ‘new normal’ we find ourselves in and the effect it’s having on our electricity demand. I know I’m using a lot less; no train to the office, no coffee machine, no 3 screen display, no post-work pint watching the football (remember pubs and football?).

A new normal?

The ‘new normal’ has manifested itself in a 25% decrease in electricity demand for April compared to this time last year. Renewable contribution has also gone from 35% in 2019 to regularly over 50% of all generation across Great Britain this month. Interestingly, I think this has given us a sneak peek (and trough!) at how the market will play out in years to come, as we continue to increase our wind and solar capacity to meet our net zero targets.

As renewable generation has an almost negligible variable cost and is often backed by Government incentives or other support mechanisms, it will continue to produce even when prices go negative. Is this a sign of a broken market? I don’t think so, the short term energy markets are still turning off the next cheapest generation facility and working as expected, it’s just strange to see the high renewable/low demand day long before we reach our net-zero generation mix. In practice, what has resulted is an increase in the price volatility on the wholesale market.

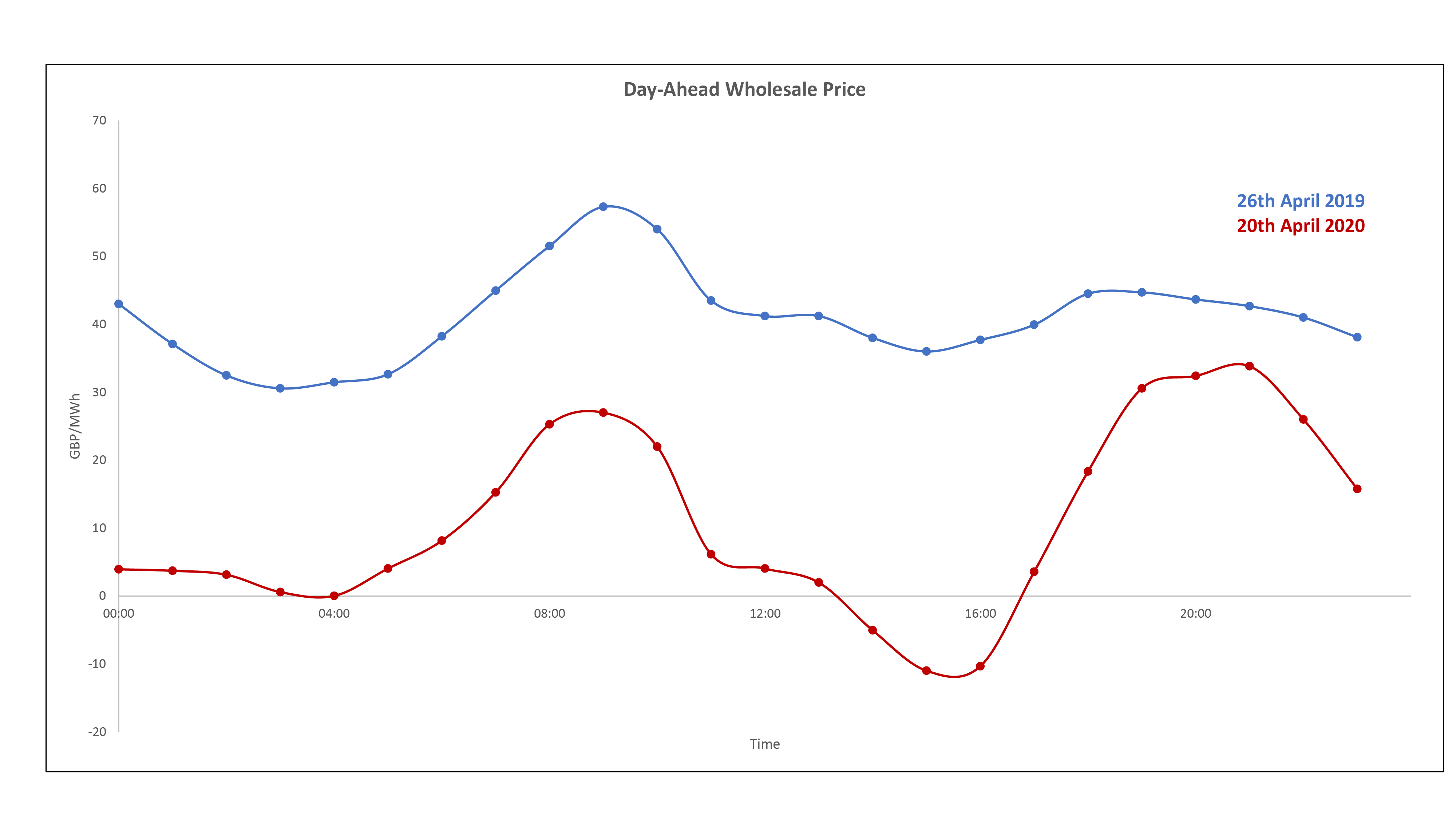

Figure 1 – Day-Ahead Prices, Source: Nordpool

Bail out or hold on?

Whilst basking in peak mid-afternoon solar output on my small patio in South-East London, I contemplated who is feeling the effects of this ‘new normal’ in the day ahead market the most. Figure 1 shows that with less demand and more solar PV generation, we are now seeing two distinct peaks and troughs across the day. GB is now experiencing the ominously termed ‘solar cannibalisation’ effect, where peak generation from your solar array ends up being rewarded with little to no value on the wholesale market. It got me thinking, how does this affect recent stand-alone PV projects that do not have the government backing of the CfD or similar schemes? Are they taking their chances on the wholesale market, or curtailing generation in order to stop losing money as this cannibalisation effect takes hold?

So, what does this mean? Is solar now a bad investment in the UK without government schemes? No. I don’t think so. The times we are in are extraordinary. A large, unforeseeable hit to demand, coupled with very low gas prices, gives us an average day ahead price so low that it was less than 1p/kWh today. It’s unprecedented.

Looking to a Net Zero future

There’s light at the end of this tunnel though. Demand will return to normal and continually increase as we further electrify our transport sector. The gas price will recover to drive a higher average power price (as CCGTs often set the power price for the UK), however with the current oil pricing, we could be seeing the endgame of fossil fuels sooner than we thought.

Nevertheless, it’s certainly a wakeup call for developers and investors. One thing that you can be certain from all of this is the shape of the power curve. Solar cannibalisation is coming, we’ve seen the early impacts in the UK and more strongly in Australia, California and Germany and it is going to grow here. Energy storage is essential to mitigate this risk. In Massachusetts, they have mandated the addition of energy storage on all solar projects over 500kWp, with further state incentives if the storage exceeds 25% of the power rating of the solar array. Maybe it’s time the UK Government started following suit? Every year, prior to the Coronavirus, the UK spends millions to turn off generation because of surplus generation. If the grid had more energy storage capacity, then we could utilise more of our clean generation (as it is often the wind assets that are cheaper to turn down), offsetting demand met by gas.

With the wholesale market prices shaping towards this ‘new normal’, market participants should be looking towards energy storage like flow batteries which thrive on high-utilisation, multi-cycle use cases and operate for decades, not years. Assets like these, co-located with solar, can hit the 2+ deep cycles a day required to effectively mitigate wholesale market risk and capitalise on the opportunities that will present themselves in the years to come.