With over 35 GWh of stationary energy storage forecast to be installed around the world in 2023, there is a lot of discussion around what the warranties for these assets will look like and what operational flexibility they will grant. In the face of change, assets with fewer warranty restrictions will deliver greater value to their owners.

Energy markets look set for a prolonged period of dynamism as renewable energy assets come onto the grid at an ever-larger scale, and storage penetration follows to help manage the increased volatility. With this change comes opportunity for battery owners and operators. Throughout this market evolution, your warranty is the guarantee that your battery energy storage system will meet certain criteria over its life and remain valuable to you in the future.

Manufacturers usually provide both product and performance warranties. A product warranty, typically a year long, ensures that the product is properly built and installed, and that it’s free from manufacturing defects. In contrast, performance guarantees ensure that the battery will continue to meet specified performance metrics – such as energy capacity, round trip efficiency or power – during the warranty period, as long as you, the operator, abide by the warranty conditions.

In order to minimize their own risk, battery manufacturers and systems integrators commonly put operational limits in their performance warranties.

This could be a cap on the number of times you can charge and discharge your battery. Or, there could be limit on the total energy throughput, beyond which the battery performance is no longer guaranteed. Some warranties model different limits and offer lower performance guarantees in higher use applications.

Using your battery outside those conditions could mean you void your warranty, or damage or degrade the system, contributing to a shorter asset life or accelerated performance degradation. Owner-operators buying battery assets today as long-term assets need to be aware of the warranty terms they are signing up for to ensure their asset will enable them to adapt to future markets.

Common BESS Warranty Restrictions & Their Impact

Depending on the storage technology you select, the operational parameters laid out in the warranty will vary. DNV has compiled a long list of common lithium ion capacity warranty restrictions. Ideally, whatever battery you choose, it will give you the flexibility of complete operational freedom.

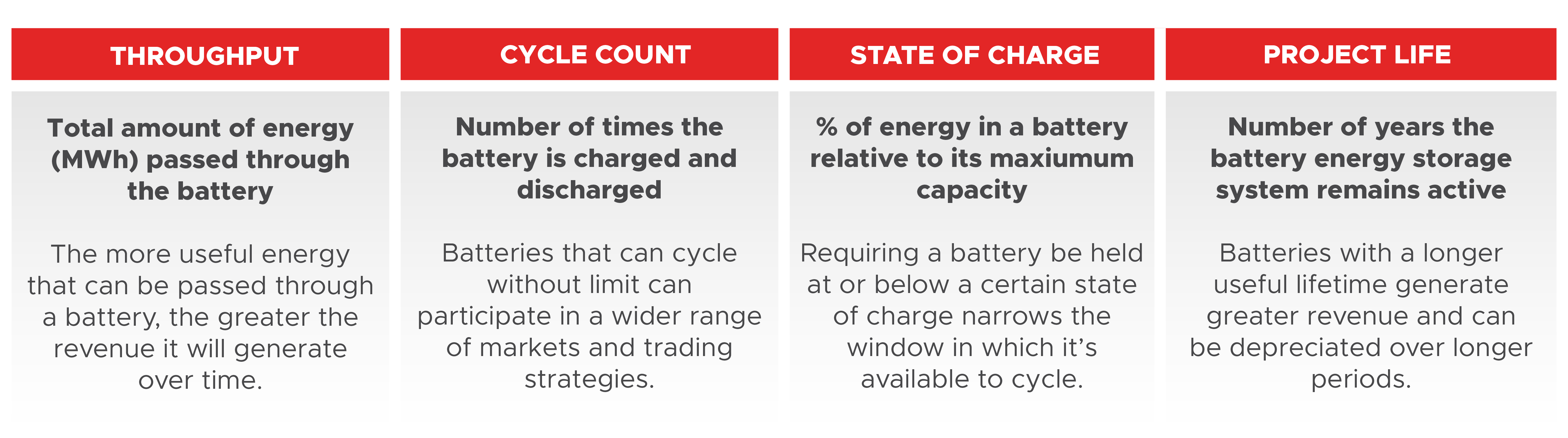

When analyzing warranties we think about four common parameters where caps and limits are often set:

/ Throughput. Throughput is the total amount of energy you push through your battery, commonly measured as the total energy discharged. For battery technologies where degradation is an issue, throughput is one of the most fundamental limits that a manufacturer can impose. Throughput limits specify that the battery will meet its performance obligations until the total amount of energy (MWh) discharged reaches a pre-determined limit. Beyond that, the capacity and predictability of the battery may degrade to the extent that the manufacturer or integrator is no longer willing to guarantee it.

/ Cycle Count. Some manufacturers limit the number of times you can cycle your battery; exceeding this count may void the warranty. Similarly to throughput, this is often used to hedge against the degradation inherent in the battery chemistry. Limits can be daily, annual or lifetime: for instance some zinc-based chemistries are limited to 6,000 total cycles, others to 500 cycles a year, and some prohibit more than one cycle a day. If your vendor is proposing warranty terms that specify a cycle count, make sure that the contract language includes the definition of a “cycle”. Some warranties don’t distinguish between full or partial charge and discharges, so whether you use 1% of 100% of the battery capacity, it could be treated the same for warranty purposes.

/ State of Charge. Many warranties impose a maximum annual or monthly state of charge, limiting how long you can leave the battery in a charged state. For instance, a warranty may specify that the battery must be kept at or below a 50% state of charge for a certain number of hours. This will limit how you can use the system and impact your revenue: i.e. you could be restricted from charging on a Saturday at attractive price to 100% SoC then waiting for a Monday morning peak price event. You might have to wait to charge it Sunday afternoon for a Monday discharge morning even if the prices are higher than they were on Saturday.

/ Project Life. In some ways, the bluntest instrument for imposing operational restrictions is to simply specify a time period in which performance is guaranteed but beyond which it is not. Depending on use, lithium-ion chemistries can degrade quite quickly; many lithium-ion cells come with maximum 10 year warranties which stipulate that they will have at least 60% capacity remaining at the end of their warranty period. Some other technologies offer much longer warranties; we are seeing more in the 20-year range today. A frequent practice is to combine a project lifetime limit with a second metric, either of which triggers the end of the warranty. For instance: “40,000 MWh or 10 years, whichever comes first.”

Figure 1. Common BESS Operational Dimensions and Warranty Considerations

Where Does This Leave Battery Owners & Operators?

Warranties should protect both parties’ interests but often place an unequal burden on the battery owner and/or operator to manage the risk.

/ You have to track these warranty limits. First of all, you need to know what limits are in place and to keep track of how you are progressing towards them over time. If you choose to file a claim, the manufacturer or integrator usually asks you to provide records of your battery operations as evidence that you haven’t exceeded the warranty limits. Some require you to maintain detailed interval data including 15 minute or even more granular data. You’ll need to show that since you owned the battery, for example, that you have never exceeded one cycle a day or that the average state of charge of the battery was kept under the 50% threshold. There are paid service providers who can collect and host this data for you in case you need to file a claim at some point, but this is an additional cost burden for data you hopefully will never need.

/ You have to stay under these warranty limits. Assuming you can track your warranty limits, perhaps with a dashboard so you know your current status, you then must ensure that your battery dispatcher stays under those limits. If you don’t, you risk voiding your warranty, degrading your battery faster, or even increasing your fire risk in extreme cases. Inherently this means that every time you use the battery, there is an underlying calculus about whether the marginal revenue you can get from the cycle is greater than the marginal cost. This usually results in battery operators setting conservative long-term strategies that stay within their warranty restrictions, such as performing just one energy trade a day with a single 2-hour discharge.

/ You have to give up revenue you could otherwise have captured. Unfortunately, with a conservative approach you risk leaving money on the table. If one thing is certain in energy markets, it’s that they are changing. Modo Energy recently charted the rapid increase from 0.1 to 0.8 average daily cycle counts over the last 2 years across the UK grid-connected battery fleet. Everywhere, change is occurring as more storage resources come online and saturate markets which are less demanding batteries. With new markets emerging – such as the UK’s Dynamic Regulation (very high cycling 2.84 cycles a day for 1-hr BESS with high value) – plus increasing opportunities in the wholesale markets, batteries are providing multiple services to increase revenue that in turns demands more from their systems.

By adjusting their battery duty cycle, owners can adapt to participate in the most useful and economically profitable markets. When warranty limitations do force you to hedge your bets, it’s difficult to predict what the best operational profile of an asset will be in a future market or when an existing PPA contract expires. If your battery’s limits are too restrictive, then they may prevent you from participating in the most profitable way. Or if you’re behind the meter, you may be unable to avoid the most expensive energy prices as tariffs change.

Warranties Without Restrictions: The Gateway to Operational Freedom

What if your battery warranty contained almost no restrictions?

If you didn’t have to worry about operational limits then you’d have many more revenue opportunities to choose at any time. You could flexibly stack revenue streams and deliver more value to the grid. The marginal costs of cycling your battery would be essentially zero.

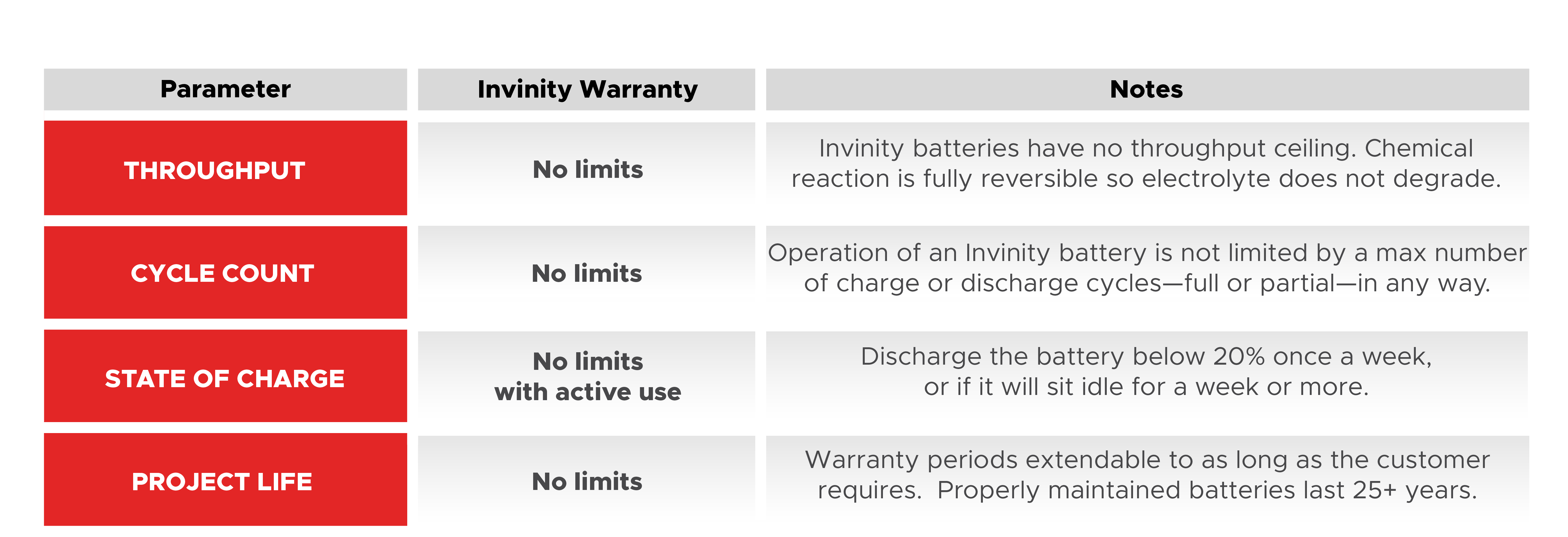

Figure 2. Operational Flexibility Afforded with an Invinity Warranty

This is the most guaranteed way to build a future-proofed asset today. Over its entire life, you’d be able to get more revenue from your battery by fully maximising its throughput and cycle counts to capture marginal revenue opportunities that would otherwise have been too costly.

No matter how many times the battery had cycled, how much work it had done before, how old it was, or what state of charge it held, if there was an economic benefit to charging or discharging, you’d be able to take it.

Giving owners full operational flexibility is the intent in our own warranty language. Invinity batteries have no limits on throughput, cycle count or how long the warranty period can be extended. The only prescribed state of charge occurs if you intend to not use the battery for an extended period of time.

How is this possible? Fundamentally, it actually comes back to the battery chemistry. The reason we use a vanadium redox chemistry in our flow batteries is that it is a truly reversible reaction. The electrolyte never degrades and with standard maintenance, battery power and capacity remain practically constant indefinitely.

Final Thoughts on Battery Warranties

We believe that high throughput batteries with great operational flexibility are the best choice for a large range of projects today, both grid connected and behind-the-meter.

These afford the greatest flexibility and future opportunity, while eliminating the costs and hassles of maintaining detailed performance data.

Whatever battery technology you choose, understanding the warranty conditions is a critical part of assessing and comparing your options. Invinity’s team of expert engineers and analysts have years of experience in projects in front of and behind the meter, in markets the world over.

If you are in the planning stages of an energy storage project today, we invite you to contact us today to start a discussion with our team.