Guest Blog: Balancing cost, benefit and risk for solar projects in a post-subsidy world

The fall in both solar and energy storage prices has been well documented and is forecast to continue. So, with capital outlay plummeting, it’s understandable that many are asking the question, why should I invest in solar and storage today if I know it will be cheaper in a few years’ time?

Ed Porter, Invinity’s Business Development Director, gives his take on this question in the next installment of our team guest blog series.

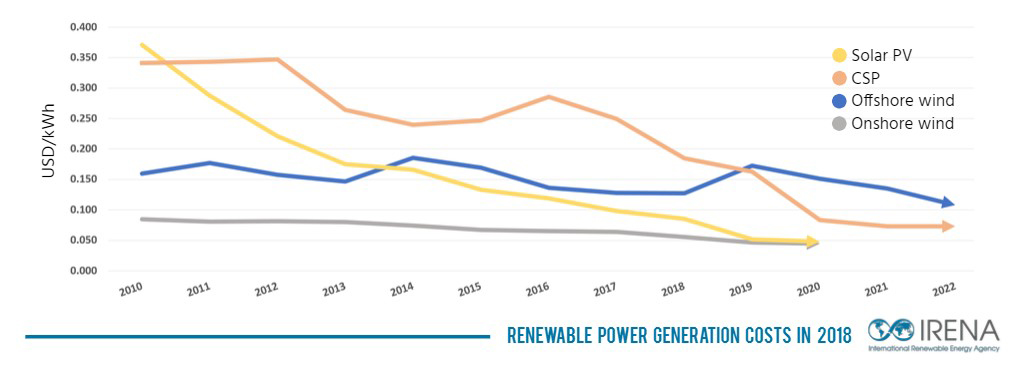

It’s true – solar costs are still falling

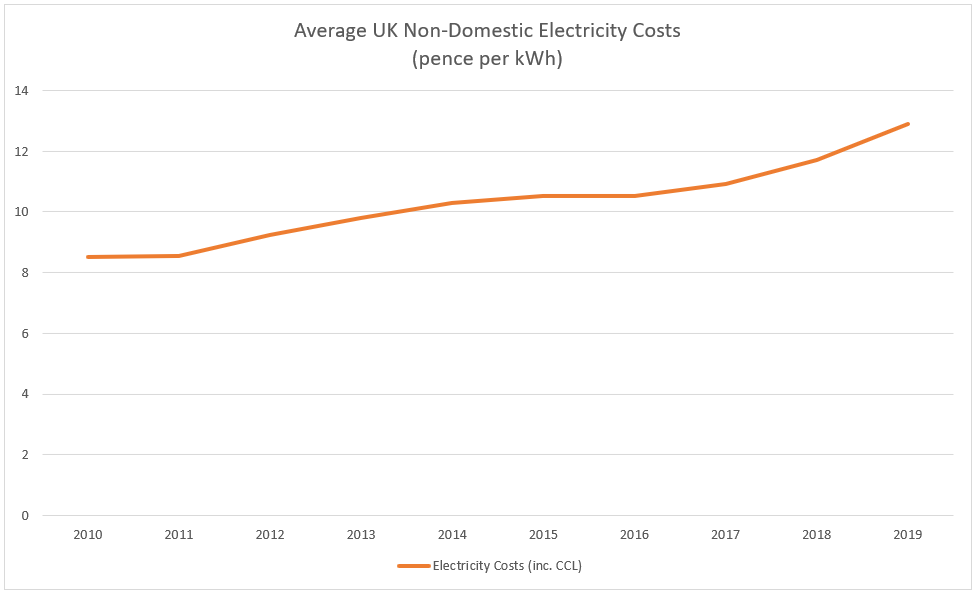

With costs falling remarkably quickly over the last ten years, solar has become a major cost saving investment for commercial energy users. Whilst UK non-domestic electricity prices have increased by more than 50% in the last decade, the cost of solar has reduced by 90% over the same period. Better still, the cost of installed solar is expected to reduce further over the next decade, dropping by c.30% by 2030, according to Bloomberg NEF.

Figure 1 – Average non-domestic electricity costs in the UK 2010-2020. Source: BEIS, March 2020

There are of course cost discrepancies between types of solar and storage installations, depending on; size, use case and location. Carport solar, for example, can cost up to 3 times that of traditional ground-mounted solar.

Figure 2 – PV cost reductions. Source: IRENA, 2018

A golden age for solar + storage projects?

The advantage of these falling upfront costs is of course shorter payback periods. For a typical behind the meter solar deployment, we are seeing customers recoup installation costs in just 5-6 years for a 20-year installation. However, as we will come onto later, this may not last forever.

Solar alone can reduce grid dependency by around 20-30% but by adding energy storage into the mix, the benefits multiply. By installing storage you can; maximise the solar capacity installed, target peak price offsets and achieve electricity cost reductions of 40%+ whilst hedging against future price rises. Adding storage is one way to mitigate risk for solar projects.

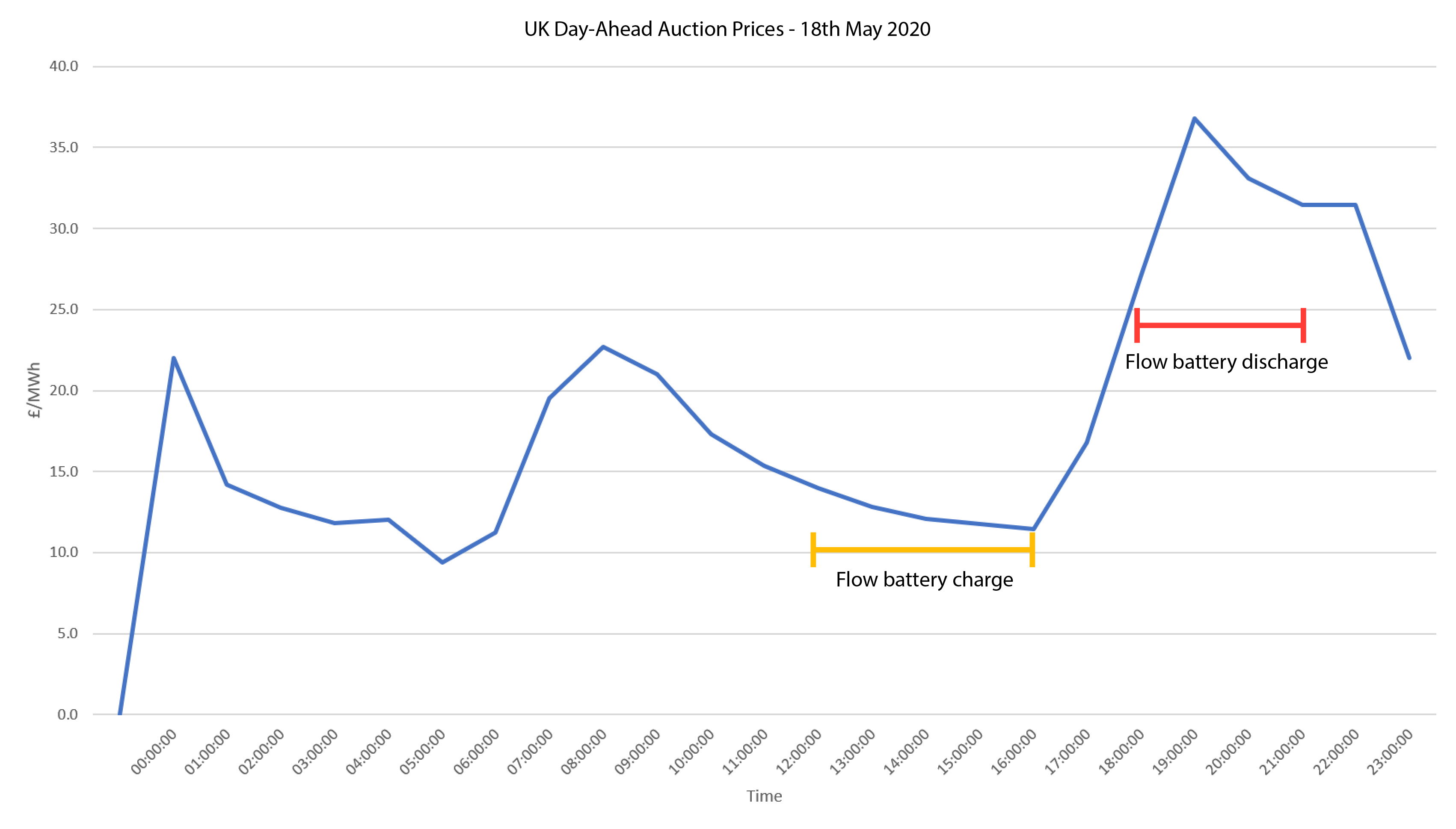

Looking beyond cost benefits, solar is low carbon, enabling users to meet emissions targets and protect bottom line. Energy storage boasts additional carbon benefits, importing during ‘greenest’ generation periods – e.g. during midday and overnight when renewable energy is a relatively large portion of supply – and discharging into peak-priced periods reducing the need for fossil fueled-powered peaking plants.

Battling the ‘Solar Duck’

As more people recognise solar’s value in undercutting energy tariffs, solar deployment will escalate.

The impact of this is well documented through the ‘solar duck’ which represents the price cannibalisation effect solar has when deployed at scale.

The solar duck raises an important point – market returns are ever changing. The shape and value of pricing in 5 years will be markedly different. Remember 10 years ago, the price paid to solar generators was 100%+ of the daily average based on expensive daytime pricing, this hardly seems possible today. We’re also observing significant daytime negative price events, something we looked at in greater detail in another of these blogs.

For prospective installers, you can address this risk for solar projects through coupling solar and storage. As energy prices reach the belly of the duck, energy storage can shift this energy to the head of the duck. This market shape is demonstrated below (noting the impact of COVID-19 on current UK demand).

Figure 3 – UK Day-Ahead pricing, demonstrating the ‘Solar Duck’. Source: Nordpool

The Goldilocks Zone: Why you should invest in Solar + Storage today

Yes, the upfront cost of solar PV is falling but as more people invest and pricing reflects the changing mix, the revenue commanded by solar could be diminished at an even faster rate, pushing up PV-only payback periods. We find ourselves in a Goldilocks period right now where the balance of cost, benefit and risk is favorable. Not to mention the carbon emitted while you wait.

The addition of energy storage can supercharge the business case for PV, reducing emissions and cutting electricity bills by 40 – 50% (or even more if you decide to opt for an off-grid system). In short, energy storage can protect your solar from less favorable future markets and ensure you’re always making best returns.

Questions or thoughts on Ed’s guest blog?

Send us an email or get in touch via the contact form