Energy Transition Economics: Are UK power prices having their own climate emergency?

Thomas Johnston, Business Development Analyst, gives his view on the unprecedented spike in UK wholesale power prices and, with COP26 just around the corner, what this could mean in the context of the global energy transition.

It has been a year of ups and downs since I last wrote a blog post. We’ve had two further lockdowns, two jabs, two Health Secretaries, one Brexit, and a whole bucketload of wholesale price volatility (the most exciting of it all!).

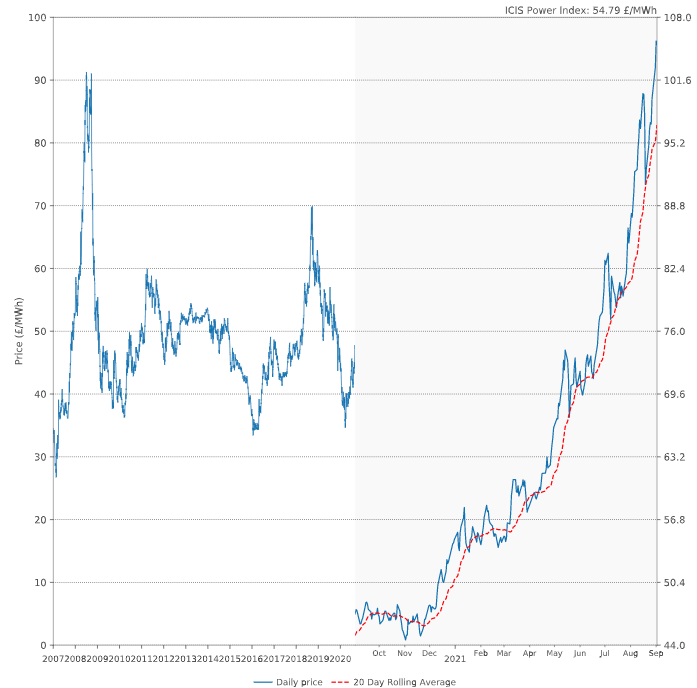

This August saw the highest average electricity wholesale price (£106.83/MWh) ever, with the effects of Covid-19 following the trend experienced after the 2007 global financial crisis. This meteoric rise means that consumers up and down the country are in for an unwelcome surprise.

Above: UK historical wholesale electricity prices 2007-2020 vs 2021 to date Source: ICIS Power Index

Why have power prices gone up so much?

There are three main reasons for this increase, the first one being gas prices across Europe reaching the highest we’ve seen since 2008. Once upon a time, OPEC, the international oil cartel, used to “mark their own homework”, collectively agreeing higher prices, with serious consequences for UK businesses. Now, with the “transition” fuel that is natural gas, we have Russia pressuring Europe for Nord Stream 2, a new gas pipeline, increasing wholesale prices already buoyant from a global Covid-19 recovery.

Unfortunately, our adopted reliance on gas has left us in this situation, strengthening the argument for the UK to improve its own energy security. If only this small island had an abundance of a natural recurring source of energy that it could exploit itself, any ideas?

The second significant reason for the price increase comes down to regulation, with the new UK ETS carbon price floating around £50 per tonne of CO2, twice what it was 2 years ago. With the Carbon Price Support at £18 per tonne on top of that, we are starting to see fossil fuel generation finally being penalised for the carbon they are emitting, excluding the carbon cost of extraction and delivery.

For those of you that aren’t aware on how the carbon price works, the UK Emission Trading Scheme (ETS) works by capping the number of emissions a sector can emit each year, with any additional emissions having to be covered by buying additional UK ETS credits.

If a company doesn’t emit as much as it is allowed, i.e. by reducing their emissions by installing wind or solar, they can then sell their remaining credits, being rewarded for taking the step towards a more sustainable future. The caps for each sector are then reduced year-on-year in line with the government’s net-zero goal by 2050. High UK ETS prices therefore reflect our limited progress towards these goals.

The third reason driving high power prices (and more UK specific) is planned outages in conventional power stations, a typical summer activity, but when considered alongside solar power’s emergence as an economically viable and sustainable investment this must be a head scratching moment for many consumers.

Simply put, there is a lot of value in renewables that can offset Combined Cycle Gas Turbines (“CCGT”) as they receive this high power price, a significant proportion of which is due to the carbon price. I think it’s fair to say that no solar developer was expecting to get paid >10p/kWh across the whole day in the middle of summer! It’s a good example of early market movers in low carbon tech being rewarded for their investment, the same is true within the energy storage space too.

Last year I questioned if Solar PV was still a good investment given the negative pricing from solar cannibalisation that we saw. As the race towards electrification intensifies, pushing up demand at current pricing, it’s fair to say that Solar PV is still a great investment opportunity, albeit with the addition of energy storage alongside.

To be clear, I don’t believe that power prices will stay at these levels for ever, but with the high carbon prices now part of the equation, the future looks bright for asset owners in this space.

COP26 – the most important yet?

Clearly, the high carbon price will have a detrimental effect on operating costs for UK industrials. These industrials can however take advantage of significant returns from installing onsite renewables and energy storage. With COP26 just around the corner, and the release of the IPCC’s AR6 “red-alert” report, our climate ‘tipping points’ have arguably already been breached. It is going to take a meteoric global effort to curb the effects of climate change.

The UK must lead the way in developing the low carbon technologies the world requires and November’s COP 26 will undoubtedly be a make-or-break moment. The cost related to the impact of climate change (even in the UK!) far exceeds the cost of supporting the development of low carbon techs, and if we can get it right, we’ll be able to exploit this investment through exports. It’s time for the Prime Minister to implement more stringent action and global collaboration, let’s hope he’s up for the task.

What’s this got to do with vanadium flow batteries?

Oh yeah, sorry, it’s hard not to get side-tracked when there’s hurricanes in Louisiana, flooding in Western Germany, heatwaves resulting in the hottest temperatures ever recorded in British Columbia and in Europe (and in Northern Ireland, my wee country!), I could go on. This is only a snapshot of what’s happening globally, and as every day passes the situation gets progressively worse. We need to rapidly transition to a net zero planet and keep investing in the technologies that are doing this – by and large, these solutions already exist, we just need to remove barriers against their widespread adoption.

With the high wholesale prices, (trading today at 22p/kWh average!) investors should feel more confident in pursuing subsidy free renewables helping to green the grid. The business case is stronger than ever, and what policy risk remains, is surely no longer a concern for investors today. As more renewables come online, fossil fuel generation will be run more sparingly, causing carbon-intensive generators to recoup more of their fixed costs when they are called upon to run.

This means that the spread in pricing, and the daily consistency of the spread, will help solidify business models for energy storage that can handle high-throughput, multi-cycle applications. Where lithium has been strong at providing ancillary services to the grid, flow batteries are well placed to handle the consistent time shifting of renewables, as we all focus our efforts on averting the worst of the Climate Emergency.