Alex Moor, Senior Energy Solution Specialist at Invinity takes a look at Australian demand charges and the energy challenges facing Commercial & Industrial (“C&I”) businesses across Australia in this latest guest blog. Here’s what business owners and energy managers need to be most aware of when it comes to energy costs and why solar-only installations aren’t always the right answer.

Fighting an uphill battle with commercial electricity bills

With a proposed charge for residential solar export to the grid and increasing lead times, complexities and cost for utility scale solar grid connection approvals, is large-scale, behind-the-meter solar & storage the next big growth area for Australia?

Australia’s residential solar sector has seen an incredible boom over the last 10-years with over 20% of residential rooftops incorporating solar PV. This has been driven through a combination of subsidies, rapidly declining panel prices and significant electricity bill savings, as customers were able to offset both the energy component alongside network costs which were recovered through simple flat rate tariffs.

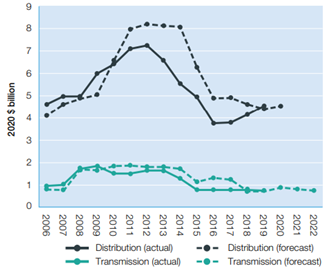

Between 2006 to 2015 residential and C&I customers saw rapid increases in electricity costs in part driven by surging investment in distribution and transmission networks. This also saw growing network operator revenues, for example, in Queensland revenues more than doubled during that period.

Investment in new network infrastructure has led to ballooning network charges which make up 40 – 60% of a typical Australian C&I bill. You can see this under your invoice summary where it is not uncommon for network charges to be the largest component. While new rules imposed on network owners by the Australia Energy Regulator to incentivise efficiency have kept network charges relatively steady, these historic inefficiencies will keep network prices high for the foreseeable future.

Figure 1, Forecast and Actual Australian Network investment 2006-2022

What are the options available?

Standalone solar installations have traditionally been a reliable way for residential customers to offset often flat electricity tariffs that rolled both wholesale energy and network costs into a single volumetric ($/kWh) rate. However, with network costs typically being recovered through peak demand charges for larger C&I customers, these costs are increasingly difficult to offset with solar alone.

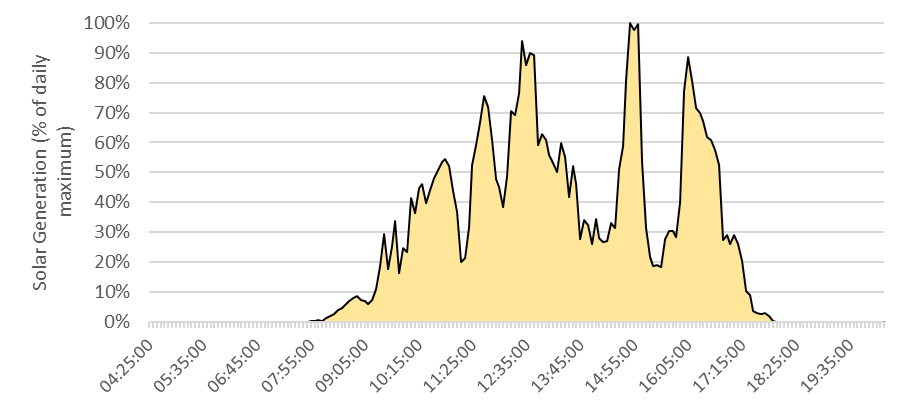

With long demand charge periods that span into evenings, complex charging regimes and the intermittency of solar generation; solar only installations have not been able to provide meaningful or reliable network cost savings for this peak demand period. As a result, the C&I solar PV sector has struggled to keep pace with both the residential and utility scale markets. Today, only about 5% of C&I sites incorporate rooftop solar. But this is about to change.

Figure 2, A single day of solar generation in South Australia showing peaks and troughs as solar irradiation fluctuates

The good news…

In the right locations, co-located solar & storage is able to leverage solar, one of the cheapest forms of energy generation, with the flexibility of energy storage to enhance the solar business model, add network savings to the array of benefits that storage can bring C&I customers and hit a project IRR as high as 20%.

However, given the large number of Distribution Network Service Providers (DNSPs), each with their own prices, varying demand charge windows and charging methodology, working out how to correctly size your solar + storage solution is not always a straightforward task. Conditions range from relatively low network charges with 24-hour demand charge periods in Victoria to potentially lucrative high value network charges with 4-5 hour demand charge periods in New South Wales.

Invinity have analysed all of the High Voltage network tariffs in Australia to understand the key considerations when building your solar & storage business models and the optimum regions for large C&I customers to gain greater control over their retail electricity bills.

Here are my three key takeaways for Australia C&I customers:

Think about charge length

Long, 10 or 24-hour demand charge periods introduce operational considerations make storage asset flexibility and DC-coupled solar & storage a priority. Recognise that your storage system may need to hold high states of charge for extended periods.

Billing periods should dictate risk management

Taking a step back from just looking at the value, the way in which DNSPs record demand charges is important. Projects in regions that implement a 12-month rolling demand charge may require increased overbuild of solar & storage capacity to ensure high system performance throughout the year. While projects in networks which bill monthly can be more easily optimised for seasonal variation in load, generation and occasionally summer peak network pricing.

Some DNSPs are just more suitable than others

With each DNSP dealing with its own unique characteristics, there is a huge variability in potential value for customers and the operation profile of the energy storage asset. While we see encouraging business models across a large number of Australia’s DNSPs, Western Power (WA), Ergon (QLD) and Essential Energy (QLD) are a few of the best performers.

Are you interested in hearing more about how to effectively size a solar + energy storage solution for your needs? Get in touch with us to learn more about the findings of our Australian commercial tariff analysis or to speak to our team more generally about a quote for a Vanadium Flow Battery for your project.