Supporting the U.S.’ increasing renewable generation base is a vital component of the transition to net zero. Ahead of their panels at InterSolar North America on 14 and 15 February, Matt Harper, Chief Commercial Officer, and Matt Walz, VP Business Development take look at what 2023 has in store for Long Duration Energy Storage (“LDES”) in the U.S.

Wednesday 8 February 2023

When announcing the availability of $350m of funding for LDES in November last year, U.S. Secretary of Energy, Jennifer Granholm said that: “advancing energy storage technologies is key to making energy generated from clean renewable resources — like wind and solar — available for 24/7 use, and is critical to achieving a decarbonized power grid.” The U.S. has very clearly recognised the importance of LDES and 2022 bore witness to a significant increase in activity for the energy storage market as a whole. The country is also leading the way in deployments – a record 4.7 GWh of energy storage was installed in Q3 2022 alone, 96% of which is in California or Texas – and it is forecast to install nearly 60 GWh by 2026. However, the sheer volume of wind and solar generation now online presents a challenge, with grid operators already having to more actively balance their existing systems without curtailing low-cost production from renewables. In light of this, what does 2023 look like for the U.S. energy storage market?

Where the Growth will Come From

One of the most positive recent developments is the bipartisan support in the U.S. for investment in the green energy supply chain, proving that the political capital to support economic growth that also accelerates the path to net zero exists even with a divided Congress.

Next, supportive and groundbreaking policies designed to accelerate the adoption of clean energy, such as the Inflation Reduction Act, are now in force. This enables energy project developers to benefit from a broad, bankable and stable tax incentive scheme – e.g. extending these credits out by 10 years to bring long-term certainty; making these credits technology agnostic (i.e. not just wind and solar but storage too); and encouraging the development of domestic content – that will accelerate both investments in industrial capacity and deployments of individual projects. Policy, as well as funding, is the primary driver of growth. It is already making it more financially attractive for solar and wind developers to incorporate energy storage and as a result, deployment forecasts are continually being upgraded. Looking deeper, there are funding competitions already in play from the U.S. Department of Energy as well as the Department of Defense, which are the results of the 2021 Bipartisan Infrastructure Law. With this government support, the industry will be able to strengthen its base of developers, manufacturers and owner/operators who will look to do more and more. Funding will also improve the viability of longer duration opportunities where the technology is less widely deployed but has been proven to work at pilot level.

A second factor is the desire for communities, business owners and cities, amongst other groups, to increase their energy self-reliance by setting up microgrids that can provide reliable low-cost, low-carbon clean energy. These can serve energy users from the growing datacenter market (where protection from increasingly regular power outages is needed) to local communities and businesses who are at a rising risk of power outages tied to climate related emergencies. At Invinity, we are already supporting new microgrids in California and Arizona and expect there to be more in the future.

These two factors are perhaps the most important drivers for this growth. But now we come to a problem, which is that the most widely deployed, and commercially ready technology that can be rolled out at pace, is based on lithium – demand for which is at an all-time high and only set to increase in the near term.

Beyond Lithium – how Alternative Technologies are Going to Take a Step Forward

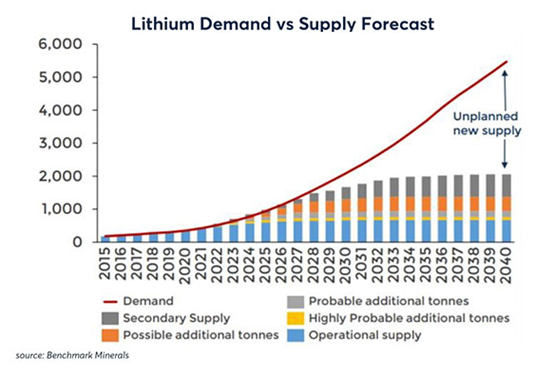

2022 showed the world the viability of the stationary energy storage market through the growing deployment of lithium-ion batteries for comparatively short durations of up to 2 hours of power. However, lithium supplies and processing facilities are limited and they also have a lengthy development cycle. Another point to consider is that it is quite probable that producers of consumer electronics and EVs are more likely to pay a premium compared to stationary storage developers for this metal because there is currently no alternative today, unlike in the energy storage industry where there are number of emerging alternatives. In any case, the lithium industry has its work cut out to match supply with demand (see chart below).

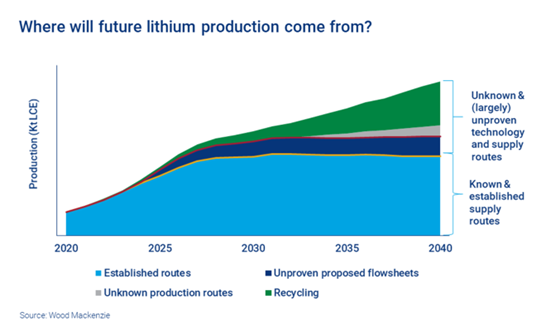

Furthermore, not knowing where this extra supply of lithium is going to come from right now leaves a gap that needs to be filled quickly (see next chart).

It is because of this, as well as all the other demand for lithium (where its use is more appropriate such as in transportation), that energy storage developers are looking for proven alternatives. This is not only helping a range of other technologies to gain more of a foothold in the marketplace (and there is room), but also, as the market and its requirements evolve, to demonstrate what capabilities are required and which technologies are able to meet these criteria, to ensure we have a properly functioning market. It is this clarity that is vital to guide investors towards choosing where to invest their money as the manufacturing base begins to grow to support it.

How will Domestic Industry Scale Up to Meet the Demand

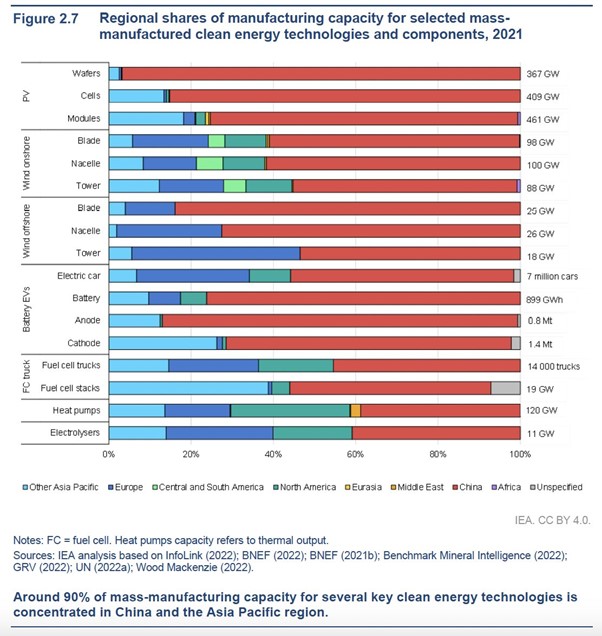

The IEA’s recent analysis of regional manufacturing shares of clean energy technologies is quite striking, even if much of this is already well-known:

China has a very strong clean technology manufacturing base and is one of the leading deployers of renewables as a result. For the U.S. to take economic advantage of the shift to electrification, renewables and energy storage, the development and expansion of a globally-competitive domestic clean energy technology manufacturing base is absolutely critical. This will not only enable countries around the world to accelerate their transition to net zero, but ensure there is a strong future pillar of their economies too and also have the benefit of mitigating some issues that arise in the global supply chain (e.g. Covid).

With this in mind, it is clear that the U.S. has given itself a strong advantage. Its useful policy support towards enhancing security of supply will encourage companies and investors to make decisions for the long term. Additionally, the U.S. Geological Survey has recently updated its critical minerals list (something it reviews every three years) to include the current required minerals needed for this transition – this will help to support the long investment periods required to build out manufacturing hubs and for major projects. Let us also not forget that curtailment of renewable energy generates negative headlines in the press too, which is going to further underline the opportunity for energy storage deployments. All of these factors will provide sufficient demand to encourage companies to expand manufacturing accordingly, because the market will support it.

Invinity has also made important progress in this direction, having initiated steps towards a joint venture with U.S. Vanadium and a distribution agreement with Maada’oozh Supply and Distribution, a wholly-owned subsidiary of Indian Energy. The agreement with U.S. Vanadium aims to give us a local base of vanadium flow battery production to meet the fast-growing demand for alternative-to-lithium batteries, enhancing Invinity’s customers’ benefits under the IRA. Invinity’s recent agreement with Maada’oozh will further support the development of customer projects in California and military bases and Tribal Lands across North America.

Unlocking a carbon free world

Given the above, it is abundantly clear that the recently enacted policy support for LDES will drive initial growth in this space throughout 2023, as long as there is a focus on ensuring the security of the entire battery supply chain. Secondly, curtailing renewable generation wastes valuable low-carbon, low-cost energy, slowing down progress towards achieving net zero goals. Thirdly, this support for grid decarbonization and broader electrification means that the U.S. should be seen to be a climate leader given the prominence of its policy support, especially as other juridictions – notably Canada and Europe – move to follow suit. Invinity is already a part of this momentum, being well-placed through our agreements with U.S. Vanadium and Indian Energy and is continuing to work hard to supply its vanadium flow batteries where they are needed, particularly at our projects in California and Arizona. If energy storage technologies, such as batteries about which the public are now much more aware, are not deployed alongside existing and new renewable deployments, we run the risk of missing our chance to take huge strides towards Net Zero in the U.S. The time to act is now.