Our Regional Sales Manager for North America, Jan Petrenko, analyses the state of the U.S. energy market in light of the recent momentous political developments in clean energy.

Friday 9 September 2022

Recent events changing the U.S. energy market landscape

2022 is turning out to be both fascinating and challenging in the U.S. energy market. Blackouts are becoming more frequent, with the average American business enduring lengthier power interruptions compared to 2015 caused by the threat of more extreme weather. Additionally, in spite of being a gas rich country, U.S. natural gas prices are being driven higher due to new international demand resulting from the Ukraine conflict, ongoing drought conditions in the western U.S., and more extreme weather. On a more positive note, President Biden’s Inflation Reduction Act, signed this month, represents the largest climate investment in American history, with $369bn earmarked for clean energy investment. This Act builds on the Infrastructure Investment and Jobs Act (which is sometimes referred to as the Bipartisan Infrastructure Act) of 2021 and shows America is ramping up investment for the energy transition, especially as 5.1 GW of energy storage has been planned for the U.S. in 2022.

Extreme weather is here to stay

It might be the obvious statement, but the weather has perhaps the greatest influence on us, and in the U.S., more and more people are noticing the effects of extreme weather. These extremes, either in the form of heatwaves or stormy weather, increase electricity demand which puts the grid under increased strain (because more people are using air-conditioning) or damages the network thus causing blackouts. However, extreme weather isn’t just a summer issue. For example, in February 2021 Texas’ grid faced emergency operations when over 35GW of generation capacity was offline due to the cold weather. In response Texas’ grid operator – ERCOT – ordered transmission operators to shed up to 20GW of load over the course of 3 days. At the moment, some of the solutions offered are for consumers to carry out a “voluntary reduction of power use” (in particular by ERCOT) to cope with increased demand. But this is not a panacea, especially when local grids are coming under increasing strain because of climate change. Small wonder then that this increased electricity demand is enhancing supply issues on an ageing grid that needs to be both supported and upgraded. Combined with the increased price of gas, which of course affects electricity generation, what does this mean for businesses?

How much have business energy prices risen this year?

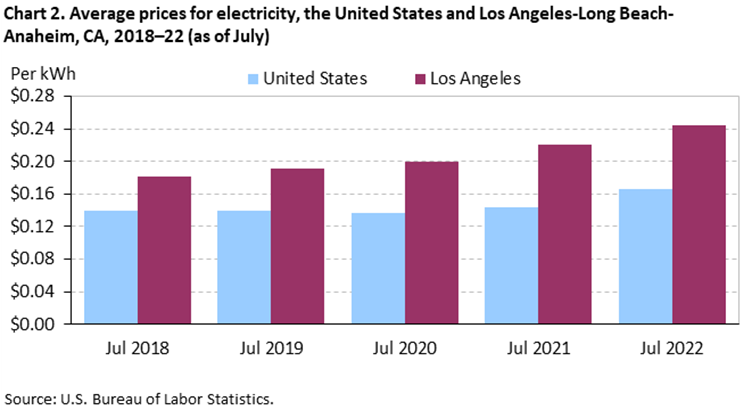

Let’s take a look at the average electricity prices across certain parts of the U.S. First, Los Angeles, which has seen a 34% increase in average electricity price since 2018:

Source: https://www.bls.gov/regions/west/news-release/averageenergyprices_losangeles.htm

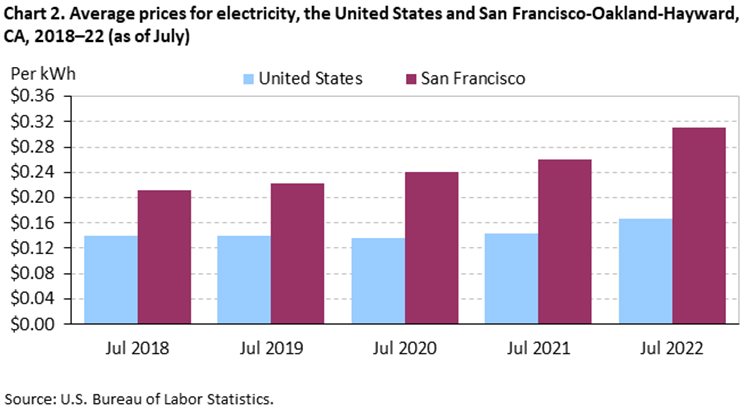

Next, we look at San Francisco which has seen a 47% increase over the same period:

Source: https://www.bls.gov/regions/west/news-release/averageenergyprices_sanfrancisco.htm

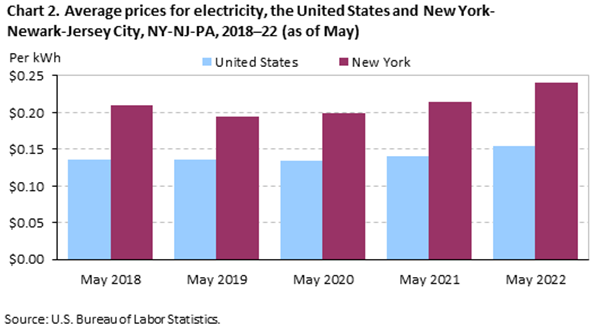

Finally, it is worth looking at New York, which, although the price has only risen 14% since 2018, the real increase is 24% when you measure from its lowest point in the period:

Source: https://www.bls.gov/regions/new-york-new-jersey/news-release/averageenergyprices_newyorkarea.htm

These charts underline quite how hard business are being hit by energy bills that have been increasing year on year. They also show that already depleted bottom lines are being stretched yet further by rising running costs, such as energy, and there does not currently appear to be an end in sight. In order to avoid continued price rises, businesses and consumers will need to know that there are options available for them, such as installing solar panels that generate cheap electricity alongside a long-lasting battery storage system, to mitigate these rises and that there is significant national support to assist with this transition.

America’s transition to clean energy has never been more real

The passing of the Inflation Reduction Act brings colossal investment support for developing not only the U.S. market for energy storage but also an entire home-based industry. What is most significant in the Act is the desire to increase the renewable power generation base for the grid, which will have the knock-on effect of enhancing demand for energy storage technology to mitigate the intermittency issue of wind and solar. It is therefore encouraging to see the Act contains $60bn of support to maintain clean energy manufacturing to the U.S. across the full supply chain of clean energy and transportation technologies and $30bn in production tax credits to accelerate U.S. manufacturing of solar panels, wind turbines, batteries, and critical minerals processing. This level of support will do much to reduce the level of investment risk, particularly as it embodies the more appropriate longer term thinking and planning that is often required when developing energy infrastructure that will last for 20 years at a minimum. We are also encouraged by this Act because it is a logical successor of the Infrastructure Investment & Jobs Act (a.k.a. the Bipartisan infrastructure law) which brought in the Long Duration Energy Storage for Everyone, Everywhere Initiative giving greater recognition to the importance of developing this industry to ensure long term energy security.

Raw Material shortages already shaping businesses’ energy storage plans

The supply chain issues that arose because of Covid are still ongoing across many different sectors. Combined with the increased demand for EVs that need lithium batteries and the recently reported lithium stationary storage battery fires and safety incidents, many developers are looking for alternatives to lithium for their battery energy storage projects. Businesses that rely on back-up power to operate in blackouts are choosing non-lithium-based batteries because of their resiliency. At Invinity, we have already seen an increase in the number of enquiries for our batteries because of their safety and durability characteristics that make them ideally suited for the stationary energy storage market.

Conclusion

Even though the U.S. still has plentiful supplies of gas (shale in particular), it is perhaps not surprising that the country is not immune to the effects of the Ukraine crisis and the weather. This provides significant evidence to support the rollout of battery energy storage to aid America’s transition to an increasingly low-carbon, renewables-based grid (it is also worth remembering that heatwaves and droughts will put pumped hydro in a tight spot for long-term reliability). Fortunately, the strong level of Government support provides the necessary investment security and lowers the risk for battery storage developers, especially for alternative to lithium technologies such as safe, reliable and durable vanadium flow batteries. A resilient electricity grid that can survive increased levels of demand as the world continues to electrify and provide low-cost, low-carbon energy from solar and wind generation combined with vanadium flow batteries will give businesses and consumers confidence for the future.