What the 2022 T-1 Capacity Market Auction Tells Us About Wholesale Market Prices for Energy Storage

Invinity’s Director of Business Development Ed Porter on the surprising late-minute changes made to the 2022/2023 T-1 auction targets.

By any measure the decision this week on the target volume for the T-1 CM auction was remarkable. The announcement by Secretary of State for Energy, Kwasi Kwarteng, to set the target at 5.36 GW – exceeding the entire available qualified pool of 5.33 GW and 600 MW above the National Grid recommendation – means that all participating assets are expected to receive the maximum price of £75/kW/year. Comparing this expected T-1 price to the T-4 price from 18/19’s auction, assets will receive an extra £69/kW/year and for 5.33GW. That’s an additional £367m for one year being paid to a small group of generators (mostly gas). When compared to the £100m made available to energy storage and flexible innovation as part of the “10-point Green Industrial Revolution”, it will be interesting to see if the UK gets value for money, particularly given that these stations were unlikely to close during record wholesale prices. .

Focusing in on energy storage – does this result signal a new windfall for storage operators? While the easy answer is yes, the broader picture and investment case is less tied to the T-1 results and more related to what they tell us about the UK and European energy markets.

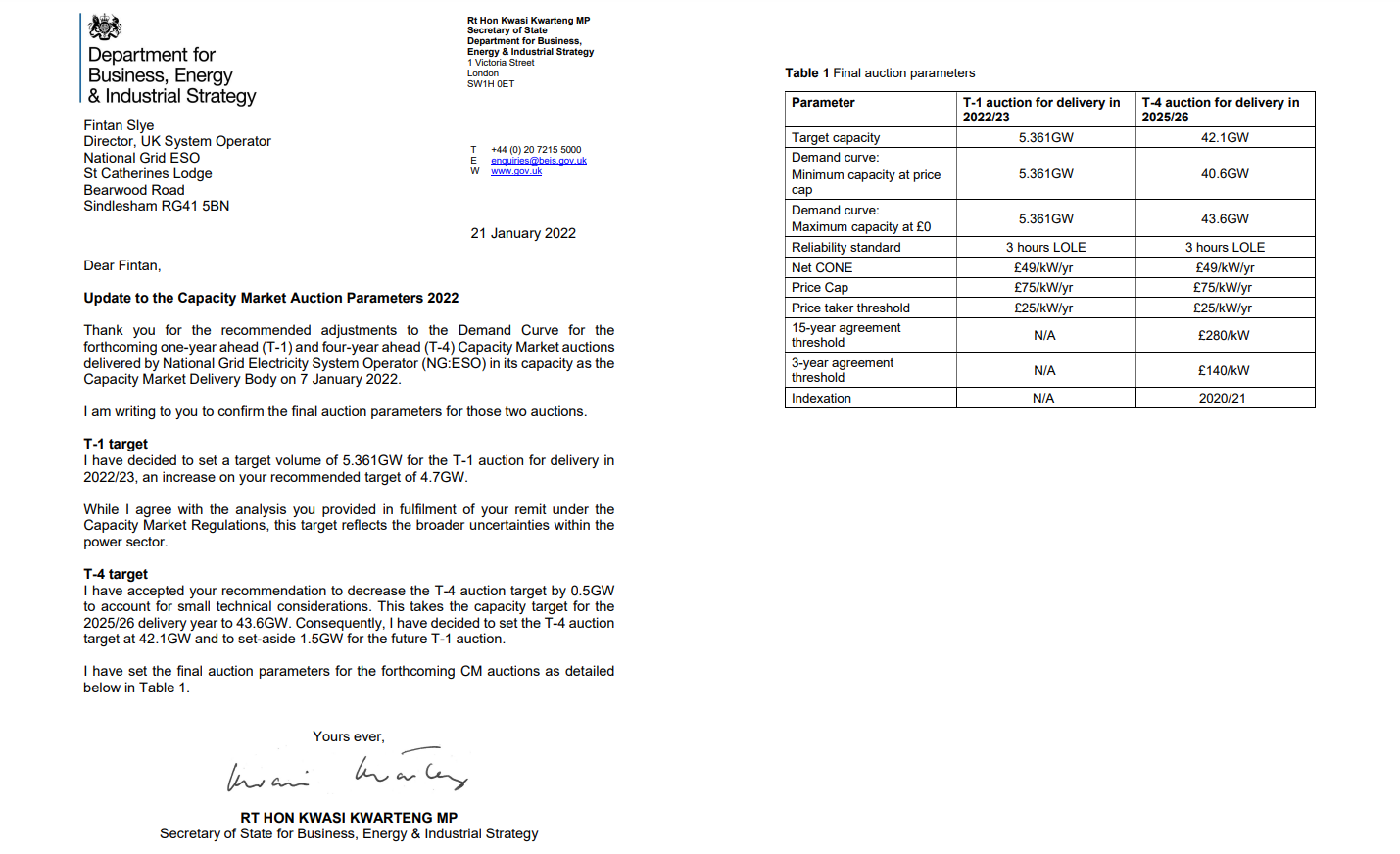

Above: The UK Department for Business, Energy & Industrial Strategy

Mr. Kwarteng’s decision to procure above National Grid’s recommendation was taken in a difficult political climate, likely with a view to protect previous policy choices. Our view is that the recent T-1 CM process has been a one-off.– It is not an effective way to operate auctions by adjusting the demand parameters after the supply can change their underlying volumes.

We believe the UK market in the medium and long term is not short on capacity. Indeed from Mr. Kwarteng’s letter to National Grid, he has reduced the volume of capacity being procured in this year’s upcoming T-4 auction. So, what do these short term actions tell us? Well, as shown in the record-breaking wholesale markets of 2021, the market is tightening, and this points to favourable returns for energy storage investments made today and for winter 2022/2023.

Above: The Secretary of State’s letter, including the final auction parameters

Timing is everything

Participating in the capacity market is one element of the “revenue stacking” used to monetize investments. There are two types of annually recurring auctions: The T-4 and the T-1, named for the delivery periods beginning 4 years and 1 year from the auction respectively. The T-4 is where the bulk of the capacity procurement takes place, usually around 40-50 GW of capacity. This auction is designed to spur new investments, including storage, by providing long-term, bankable returns beginning 4 years out.

The T-1 is where final true-ups take place, as what the grid needs comes into clearer focus. From recent news, it is also now where policy setters can take more tactical action. For instance, if a large power plant encounters installation problems and delays, then the T-1 procurement attempts to cover that shortfall. The T-1 auction usually procures 2-5 GW of capacity.

The reason why T-1 is lower than the T-4 is because, conventionally, it takes 4 years to build 100 MW+ power stations from scratch, so if the UK is short of capacity, then it’s best to determine this in T-4 and not in T-1. Often, the T-1 auction prevents power plants that missed T-4 contracts from closing permanently; these are generally older stations that couldn’t justify staying open with the T-4 price. Recently, quicker to build or earlier than expected assets like electrochemical energy storage, reciprocating engines and CCGTs have also taken market share in the T-1 auctions.

When considering energy storage investment options, asset owners also need to consider CM contract types, of which there are 3: new build, refurbishment and old. These contracts have varying lengths of 15, 3 and 1 year(s) respectively. With 15-year new build T-4 contracts, owners will receive that auction price for 15 years, which is highly bankable.

What we can learn from previous CM auctions

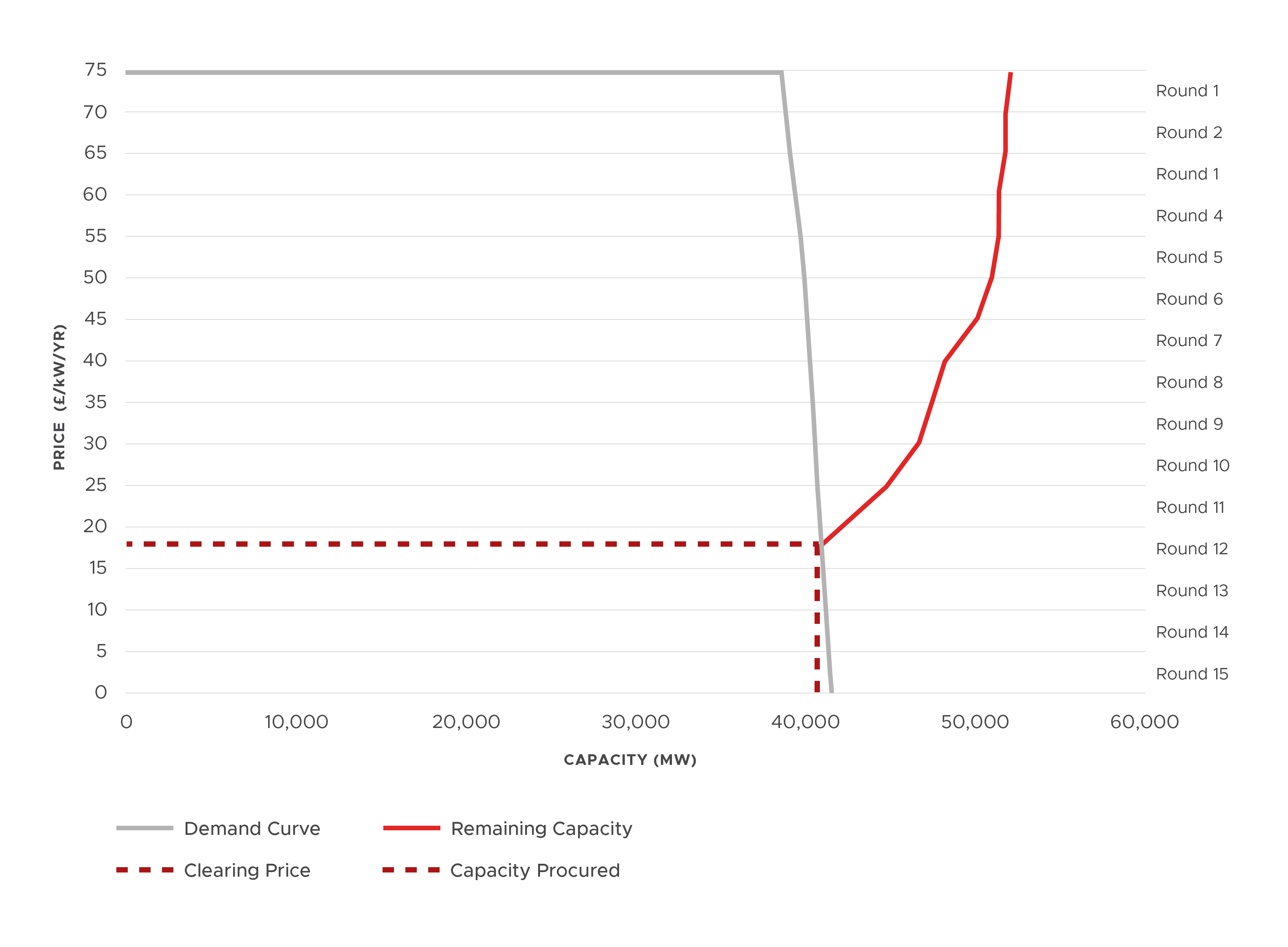

The most recent T-4 auction (20/21) results stand in contrast to this recent gap in capacity, as shown in the figure below.

The blue line is the National Grid’s forecast demand curve, reflecting the grid’s anticipated need for capacity. It’s slightly curved as the operator wants to ensure more capacity at lower prices to minimize any chances of blackouts.

The maroon line is all the capacity that registered for the auction (the CMUs) but chose to drop out of the market and receive no CM payment. Effectively, the last T-4 auction saw 50 GW+ of CMUs register but c.10 GW wasn’t built due to an oversupply vs. National Grid’s requirements.

Some might challenge the National Grid’s forecasting process, but whether they are correct or not, the recent T-4 auction does not suggest a shortage of new build capacity in the UK.

Above: T-4 Auction (Delivery Year: 2024-25) – Published Round Results via National Grid/EMR

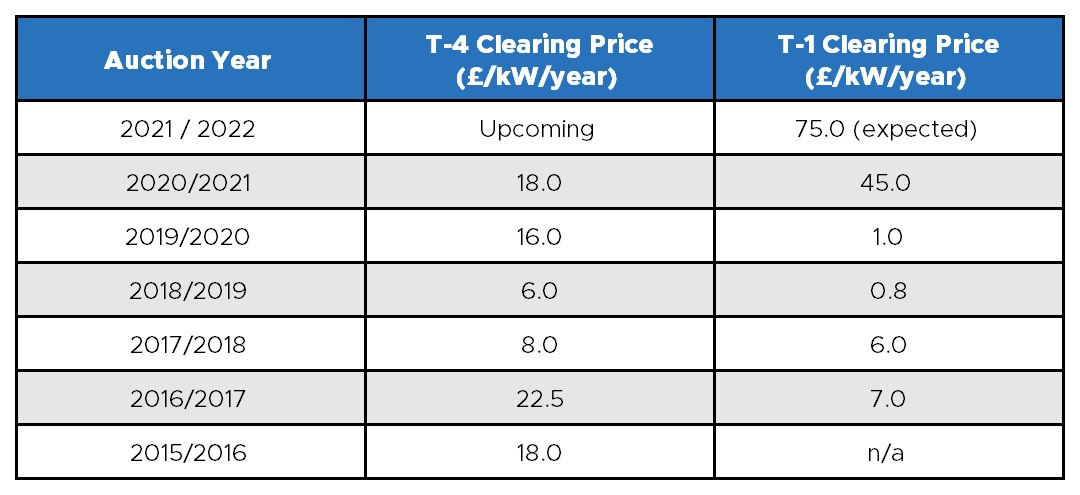

This is further reinforced when we look at historical clearing prices in the auctions (shown in the table below). The cost of a new entrant into the UK capacity is around £49k/MW/year (as set out in the Secretary of State’s letter. This, if markets act well, should be the limit to price increases.

The 21/22 T-1 auction is an obvious outlier in this data set; clearly changing the boundaries of the auctions after registration is not an effective functioning of a market.

Above: Historical UK Capacity Market T-1 and T-1 Auction Clearing Prices, 2015-2022

Takeaways for energy storage

Batteries provide capacity and receive CM payments. Like all assets, if there is a capacity market event and an asset is not running, the asset will lose a pro-rated 1/24th of their payment per CM event not responded to.

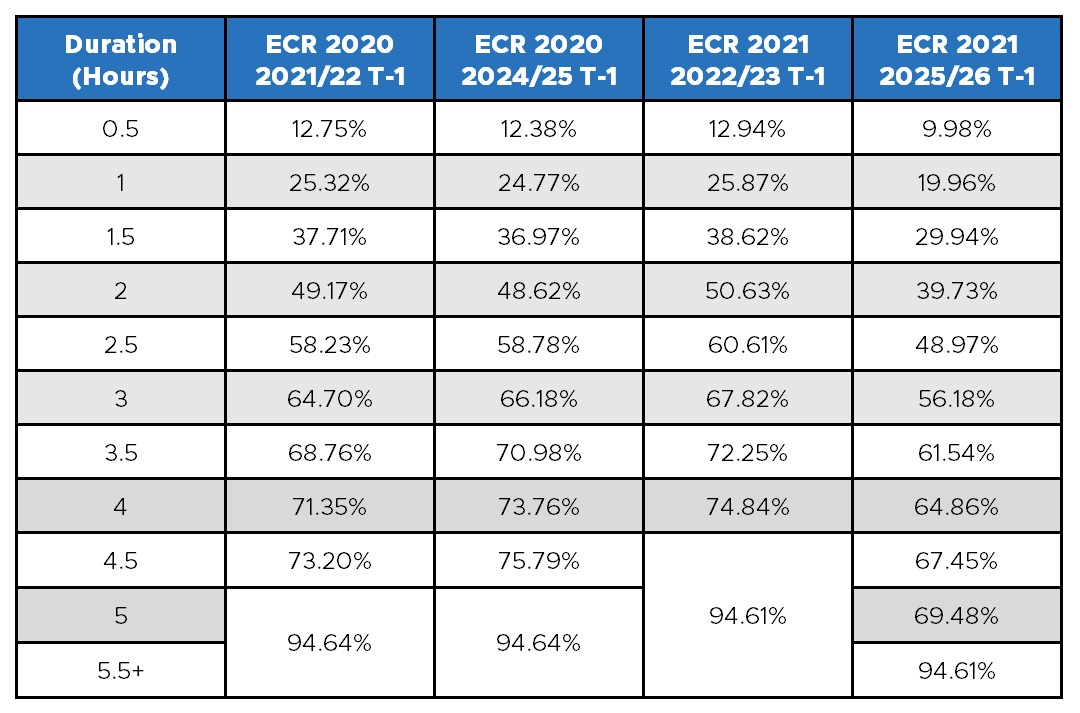

However, National Grid know that in a CM event (a shortfall of capacity) that batteries can only dispatch what they have stored, hence the storage CM payments are de-rated based on the discharge duration. A 2-hour battery is de-rated to 39% of the CM payment, while a 3.5+ hour battery (like vanadium flow) is credited with 62% of the payment. (See table below).

Above: De-rating Factors for “Duration Limited Storage” via National Grid/EMR

Most energy storage investments in the UK are in the 1-2 hour range. Due to the de-rating (30%) and typical capacity market prices (£15-20k/MW/year), batteries typically earn just under £10k/MW/year. Over a 15-year contract, this CM payment is a contributing revenue stream, but in fact only adds a small percentage to the average storage business case.

More critical are the wholesale trading and ancillary service returns generating around £100-150k/MW/year. With these in mind, what do the recent auction results tell us?

The capacity market is a bellwether, and the last-minute adjustments more so. The rising CM prices, even if they are an anomaly, are indicative of a tightening market, and a tighter market indicates that wholesale trading is becoming more lucrative.

Already, wholesale market prices in the UK are hitting record levels. The nation’s Net Zero goals are driving a rapid electrification of the country’s industrial and transport sectors. At the same time, the increasing penetration of renewables on the grid has made energy production more time-dependent and inherently less dispatchable. And the situation is further compounded by the geopolitical risks to a reliable supply of natural gas which remains the key fuel for electricity generation.

This is the landscape in which projects siting energy storage alongside renewable energy generation are emerging as some of the lowest-risk, highest-return investments in the energy sector today. Unburdened by carbon emissions, clean renewable energy is cheap and reliable. Pairing long duration storage gives operators control of a dispatchable renewable power plant, ideally suited to shift 8 or more hours of energy to times it is most needed, and capture increasingly lucrative wholesale market and ancillary service revenues. While the latest T-1 auction results suggest a bullish outlook for capacity market revenues, they are in fact just the icing on the cake for investors.