Our Regional Director for Australia, Michael Rutt reports on the current state of the Australian energy market and assesses the options available to counteract energy price volatility.

Thursday 14 July 2022

Looking at the Australian Energy Market

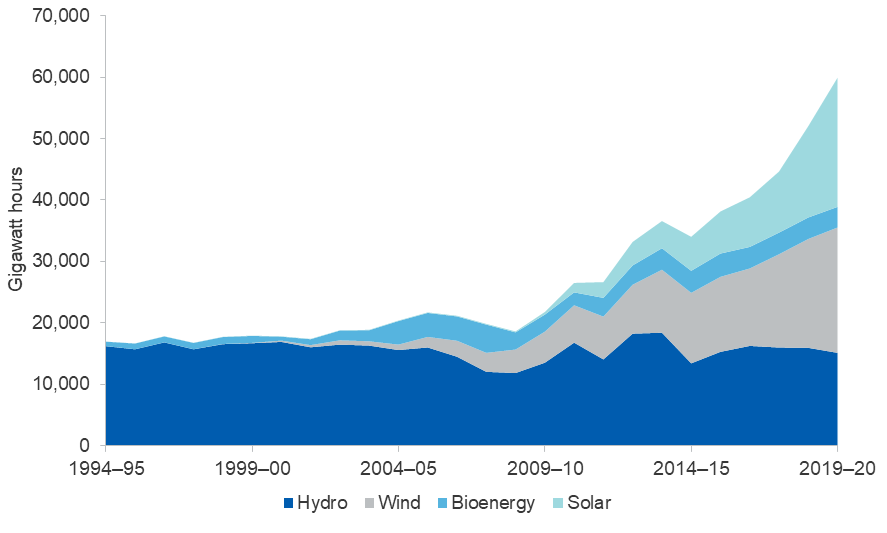

Over the last few years, Australia has enjoyed a downward trend in wholesale electricity prices driven by record renewables growth, lower electricity demand and low natural gas prices.

Source: Australian Government, Department of Industry, Science, Energy and Resources (2021), Australian Energy Statistics

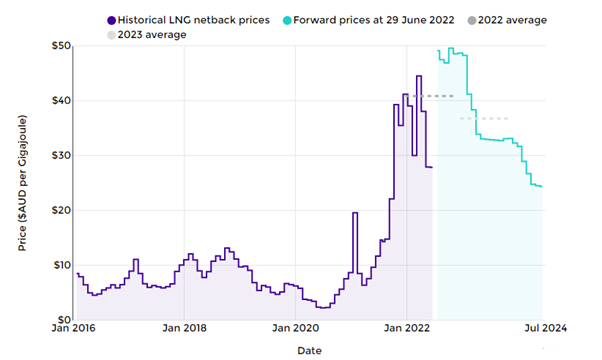

However, these periods of low natural gas prices are already a distant memory. The wholesale electricity market experienced its first market suspension following a perfect storm of events: cooler weather, planned and unplanned coal outages and increased natural gas demand from Europe that has driven up domestic natural gas prices. In turn, faced with an electricity wholesale market price cap of $300/MWh and even higher costs, natural gas generators and other assets withdrew capacity from the market, resulting in ever-tightening capacity margins and skyrocketing wholesale electricity prices. Although the market suspension was lifted after 8 days, it is by no means the end of the story as wholesale electricity prices have remained high and the NEM is in a familiar state of affairs that could lead to a potential second market suspension.

Australian historical and forward LNG netback prices to 1 July 2022. Source: accc.gov.au

However, while residential electricity prices are often at the forefront of the news with readily available information on suppliers’ websites and price comparison sites, larger commercial & industrial (C&I) customers are often faced with a relatively opaque market.

Business Energy Prices

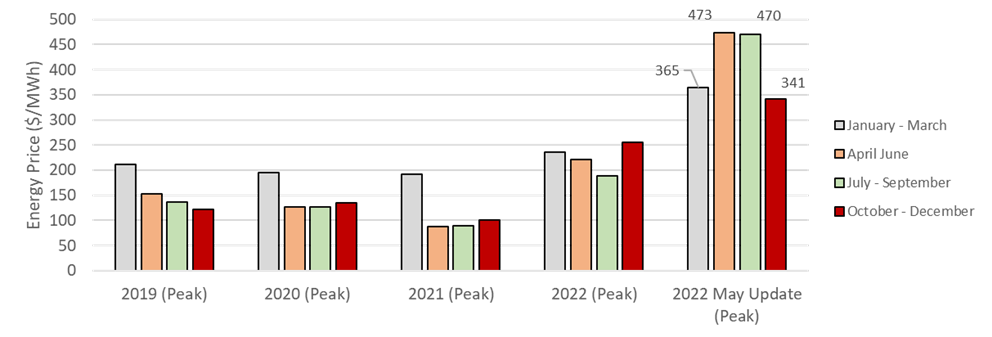

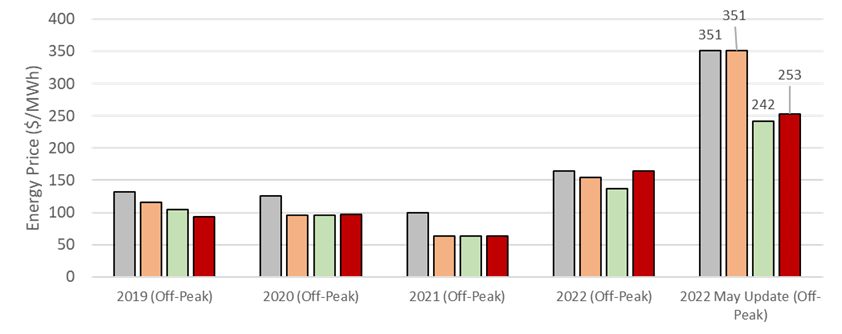

Invinity has tracked the “default wholesale electricity rates” for large C&I electricity customers from one of Australia’s largest energy retailers over the last few years, which has seen the wholesale electricity cost component (typically making up 30-40% of the total electricity costs in addition to network charges and environmental levies) declining slightly year on year. This decline abruptly stopped when the updated default rates were released in January 2022 resulting in a 110% increase in peak prices as global commodity prices continued to surge.

Figure 1 – Quarterly default tariff peak energy rates for large C&I customers

Figure 2 – Quarterly default tariff off-peak energy rates for large C&I customers

Default rates were hiked again in May, rising between 55% – 150% with Q2 peak electricity rates (excluding network or environmental charges) rocketing from $87.8/MWh to $472.7/MWh. Yet as recently as November 2021, the Australian Energy Market Commission published its residential electricity price trends report forecasting a continued downward trend with prices expected to decrease through to 2023 – 2024, however the forecasts become almost immediately obsolete due to the unprecedented pace of pricing change.

Protecting Business from Energy Price Volatility

Over the last 15-years, solar PV has been deployed with huge success in the residential sector backed by attractive federal support schemes and flat rate tariffs consumers reduce their bills. However, the C&I sector typically has a higher proportion of time of use charges (with peak and off-peak energy rates and network demand charges) and incorporating energy storage into solar PV projects will help customers control when they import from the grid. With a well-designed solar & storage system, C&I customers can expect to see their annual electricity grid imports reduce by up to 70% with a significant reduction in import during peak network demand periods.

In this era of radical uncertainty, particularly driven by an unprecedented rise in wholesale gas prices but also unplanned outages and supply chain challenges for coal and gas, market analysts are finding it increasingly difficult to anticipate complex system / market events and therefore carry out accurate forecasting. This will also increase uncertainty for businesses, especially energy intensive ones, in forecasting their operating costs. Therefore, developing robust strategies to take control of your energy supply such as using a solar & storage solution is becoming more and more important for businesses across Australia.

Enhance Energy Security With Battery Energy Storage

Energy storage assets including Invinity VFBs that provide high cycling capabilities and longer duration storage enable businesses to install and utilise the maximum amount of onsite solar. Rather than waiting months or even years for costly network upgrades, a well-designed solar plus storage system, utilising longer duration, heavy duty vanadium flow batteries is often a better option. By generating and using their own low-cost, low-carbon solar energy, available on-demand thanks to Invinity’s flow batteries, commercial businesses across Australia can reduce their energy costs, cut their carbon footprint and take back control of their energy future.