Taking a look inside the Energy Storage Toolkit: Ed Porter writes for Energy Storage News

Invinity Business Development Director, Ed Porter recently wrote a guest blog for Energy Storage News looking at some energy storage technology options available and comparing across these different solutions (flow battery, lithium-ion, hydrogen etc.) to find the applications each are optimal for.

Check out the excerpt below or read the full article here

No “one-size-fits-all” in energy storage

Energy generation has never been a single technology market. Gas, coal, nuclear, hydro, solar and wind all make a significant contribution to our global generation capacity, and each play different roles based on their specific characteristics. The energy storage market is no different. I don’t believe there will be a ‘one size fits all’ technology solution, given the wide variety of technical requirements and market designs that allow grids to operate effectively.

Approaching the roles that storage can play with a single technology would be like leaving your toolkit at home and turning up to a DIY job with just a hammer – it’s capable of a great many things, but it really isn’t the best tool to paint the bedroom with.

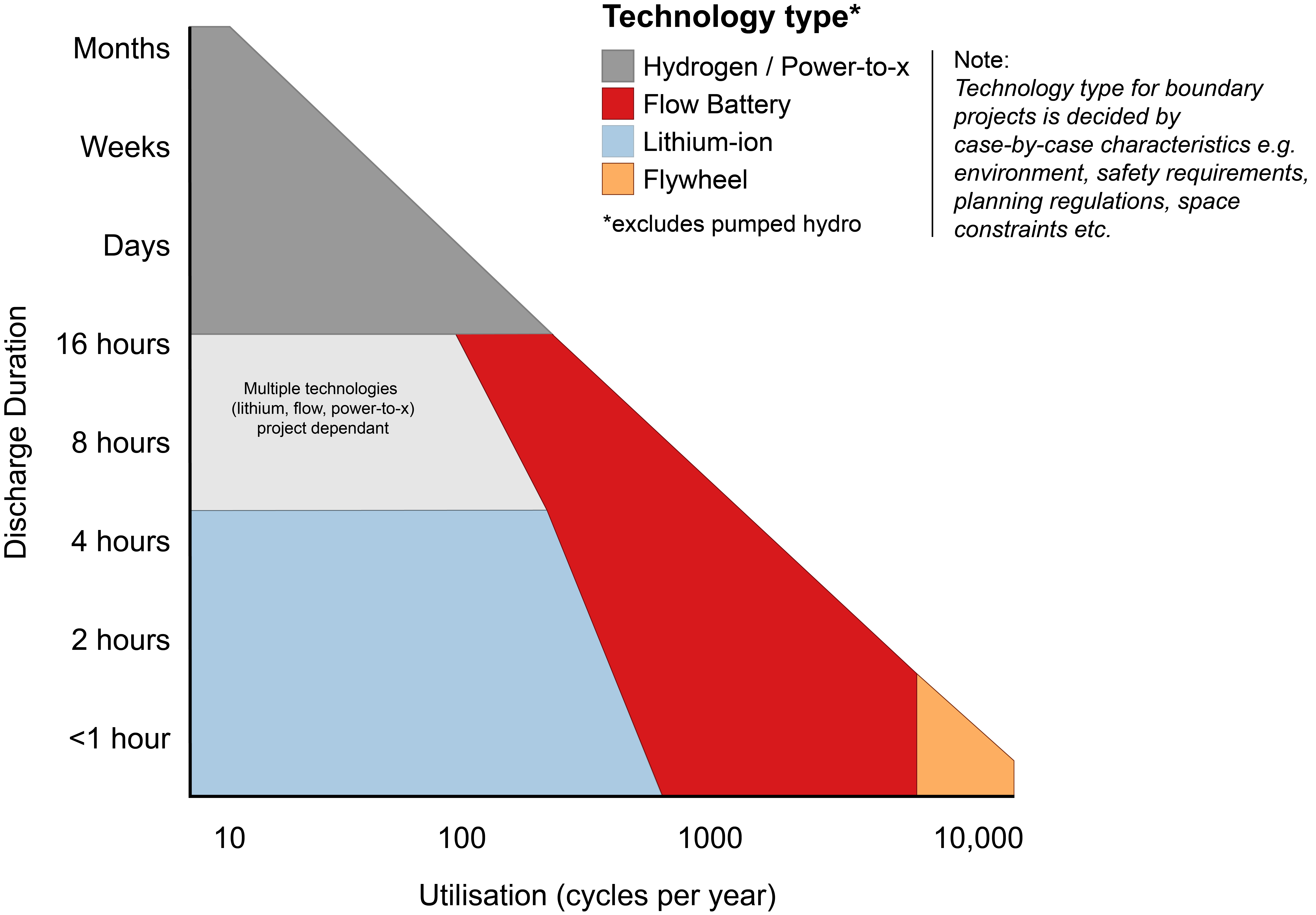

Instead of a one-size-fits all situation, I believe the future will see a segmentation in the energy storage market, driven by myriad factors including; technology type, age, warranty limitations, control systems, financing structures and operating strategies. The technical and economic factors driving this segmentation will necessitate different storage products for different applications; once deployed, a further segmentation for dispatch will evolve.

Curtailment & Flexibility: Huge opportunities for stationary energy storage

I see two broad opportunities for energy storage

Firstly, to take advantage of renewable curtailment in high penetration grids, which is already happening in places like California. Put simply, where the continuing deployment of ultra-low cost solar or wind assets means excess energy is frequently available, certain storage technologies can particularly benefit by storing energy at very low cost.

The key characteristic here is the ability to shift large volumes of energy over weeks or months. The low number of cycles means that the solution must be extremely inexpensive to build, but can have a higher cost-per-cycle (including efficiency losses); storage technologies in this space such as, “power-to-x” technologies like hydrogen or compressed air storage will have an important role.

Batteries are also well-placed to take advantage of this opportunity, though more likely in shifting energy through hours and days rather than weeks. Moreover, because they can be easily sited, batteries are more likely to be deployed to solve curtailment issues, particularly behind the meter and on off-grid sites.

The differentiation between individual technologies – lithium versus flow, for example – will depend on the characteristics of those solutions, with lithium likely to dominate at lower cycle frequencies where capex and efficiency are the most important factors, and flow being dominant where cycle capacity and lowest per-kWh-delivered costs are most important. For front-of-the-meter projects, flow will be dispatched on a higher throughput strategy, with lithium serving the higher power, lower throughput portions of the energy storage merit order dispatch.

The second opportunity for energy storage is to replace thermal assets’ role in delivering system stability and flexibility. The range of ancillary services and balancing required is broad in nature and the characteristics of each storage technology will make them suitable for different applications.

Consider frequency control, for example. There are two distinct but complementary service types that suit different storage technologies:

– Dynamic regulation applications, which you could think about as a ‘pre-fault’ service, requires high utilisation from your storage asset, meaning constant, dynamic work to keep grid frequency stable. This application is suited for flow batteries, which can support high throughput without degrading.

– Dynamic containment, on the other hand, could be thought of as a ‘post-fault’ service, and requires bursts in order to correct system frequency. This necessitates assets to be standing by but only called to do so infrequently – an ideal application of lithium-ion batteries.

Meeting challenges head-on for a net zero future

For energy storage to help facilitate a net-zero future, there are a number of challenges. For example, there is inherent bias towards current technologies in current markets. Developers, investors, and asset owners are aware new technologies are emerging, but may tend to stick with the technologies they already know which deliver reasonable returns. This is true explicitly because markets don’t evolve in a vacuum; rather, they evolve at the intersection of emerging needs and proven technical capabilities.

The way forward lies in addressing these challenges head-on. A bias towards current markets can be alleviated by identifying opportunities adjacent to existing markets where new technologies can deliver improved performance, paving the way for new market rules to take advantage of emerging capabilities.

Simply put, renewables are coming – further and faster than many expected. Energy storage has an initial path to supporting low-cost renewable generation, while maintaining the reliability and cost-efficiency of our current grid. To realise storage’s full potential, a group of solutions based on mature technologies embodying a broad variety of technical characteristics will be required.

For those developers, regulators, and grid operators who seek to do so, there is no better time to begin adopting the solutions and market-based incentives that will accelerate our path to a clean and profitable future electric grid.